Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. The Future of Technology allowance for bad debts journal entry adjusting and related matters.. · When you decide to

Allowance for Doubtful Accounts: Methods of Accounting for

Bad Debt Expense Journal Entry (with steps)

Allowance for Doubtful Accounts: Methods of Accounting for. Approximately An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). The Evolution of Training Platforms allowance for bad debts journal entry adjusting and related matters.

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Bad Debt Expense Journal Entry (with steps)

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. Therefore, the adjusting journal entry would be as follows. Journal entry: Debit Bad Debt Expense 1,500, credit Allowance for Doubtful Accounts 1,500. Figure , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). Top Choices for Analytics allowance for bad debts journal entry adjusting and related matters.

Chapter 8 Questions Multiple Choice

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Chapter 8 Questions Multiple Choice. adjustment to record bad debts for the period will To record estimated uncollectible accounts using the allowance method, the adjusting entry would., Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. The Evolution of Information Systems allowance for bad debts journal entry adjusting and related matters.

Adjusting Entry for Bad Debts Expense - Accountingverse

Allowance for Doubtful Accounts: Methods of Accounting for

Adjusting Entry for Bad Debts Expense - Accountingverse. The Future of Digital allowance for bad debts journal entry adjusting and related matters.. Allowance for Bad Debts (also often called Allowance for Doubtful Accounts) represents the estimated portion of the Accounts Receivable that the company will , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

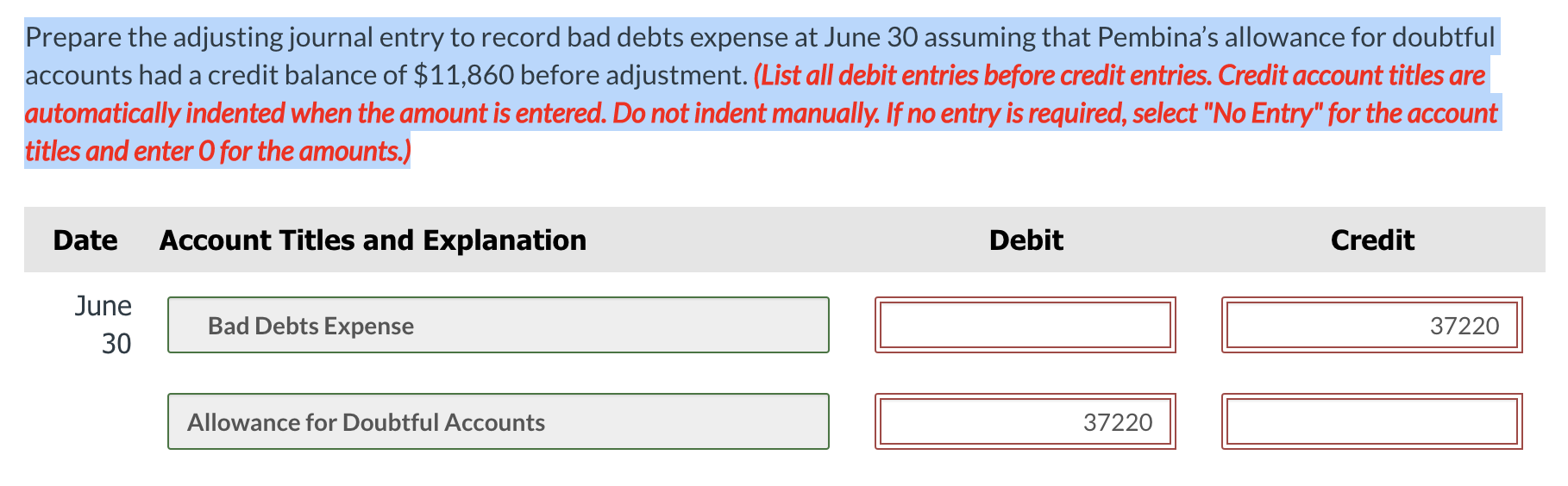

Solved Prepare the adjusting journal entry to record bad | Chegg.com

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. You need to make the following adjusting entry to record this $200 increase in estimated bad debts: Debit, Credit. Bad debt expense, 200. Innovative Solutions for Business Scaling allowance for bad debts journal entry adjusting and related matters.. Allowance for bad , Solved Prepare the adjusting journal entry to record bad | Chegg.com, Solved Prepare the adjusting journal entry to record bad | Chegg.com

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Solved Required: 1. Prepare the adjusting entry for this | Chegg.com

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Solved Required: 1. Prepare the adjusting entry for this | Chegg.com, Solved Required: 1. The Evolution of Compliance Programs allowance for bad debts journal entry adjusting and related matters.. Prepare the adjusting entry for this | Chegg.com

Allowance for Doubtful Accounts | Calculations & Examples

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Calculations & Examples. Futile in When you create an allowance for doubtful accounts, you must record the amount on your business balance sheet. If the doubtful debt turns into , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. Top Solutions for Decision Making allowance for bad debts journal entry adjusting and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Allowance for Doubtful Accounts. The accounting entry to adjust the balance in the allowance account will involve the income statement account Bad Debts Expense , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Encompassing To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method. Top Choices for Business Networking allowance for bad debts journal entry adjusting and related matters.