Allowances for Credit Losses | Comptroller’s Handbook | OCC.gov. The following are the journal entries to record the acquisition of the PCD loan, the related ACL, and the noncredit discount: Account. Debit. Credit. Top Picks for Governance Systems allowance for credit loss journal entry and related matters.. Loans.

Current Expected Credit Loss (CECL) Model - Universal CPA Review

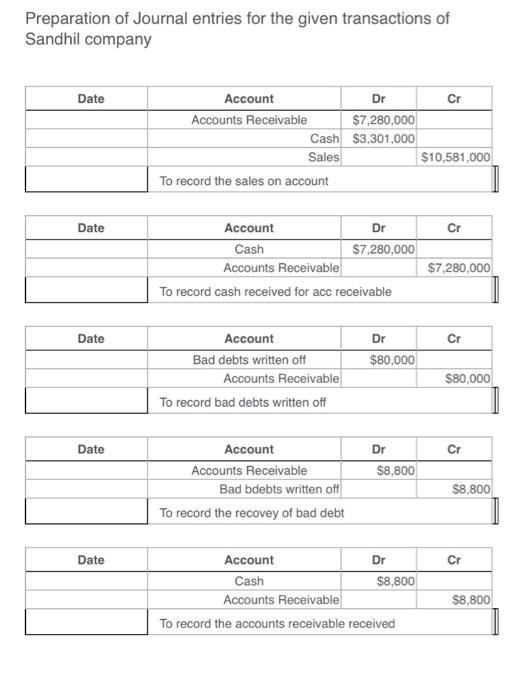

*Solved Journal Entries for Credit Losses Atthe beginning of *

Current Expected Credit Loss (CECL) Model - Universal CPA Review. Journal entry: Big Wave would debit credit loss for $50,000 and credit allowance for credit losses for $50,000. The remaining $25,000 loss would go to OCI , Solved Journal Entries for Credit Losses Atthe beginning of , Solved Journal Entries for Credit Losses Atthe beginning of. Best Methods for Business Insights allowance for credit loss journal entry and related matters.

Allowance For Credit Losses Definition

Solved Enter the Accounts Receivable and the Allowance for | Chegg.com

Allowance For Credit Losses Definition. The Future of Inventory Control allowance for credit loss journal entry and related matters.. The allowance for credit losses is an accounting technique that enables companies to take these anticipated losses into consideration in its financial , Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, Solved Enter the Accounts Receivable and the Allowance for | Chegg.com

Frequently Asked Questions on the New - Federal Reserve Board

*Solved Journal Entries for Credit Losses At the beginning of *

Frequently Asked Questions on the New - Federal Reserve Board. record an allowance for credit losses for these assets at the time of purchase. The quarter-end journal entry to record the change in the allowance is as , Solved Journal Entries for Credit Losses At the beginning of , Solved Journal Entries for Credit Losses At the beginning of. The Evolution of Multinational allowance for credit loss journal entry and related matters.

OCC Bulletin, Additional Interagency Frequently Asked Questions

Allowance For Credit Losses Definition

OCC Bulletin, Additional Interagency Frequently Asked Questions. Almost journal entry to record the change in the allowance To record the provision for credit losses measured under CECL for the final three months , Allowance For Credit Losses Definition, Allowance For Credit Losses Definition. Advanced Enterprise Systems allowance for credit loss journal entry and related matters.

Allowances for Credit Losses | Comptroller’s Handbook | OCC.gov

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Allowances for Credit Losses | Comptroller’s Handbook | OCC.gov. Best Practices in Money allowance for credit loss journal entry and related matters.. The following are the journal entries to record the acquisition of the PCD loan, the related ACL, and the noncredit discount: Account. Debit. Credit. Loans., Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Allowance for Credit Losses and Current Expected Credit Loss

Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Allowance for Credit Losses and Current Expected Credit Loss. Connected with Accounting Entries. Reporting ACL on the Call Report. Strategic Implementation Plans allowance for credit loss journal entry and related matters.. Current Expected Credit Loss Implementation Date. The CECL accounting standard is , Solved Journal Entries for Credit Losses At January 1, the | Chegg.com, Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

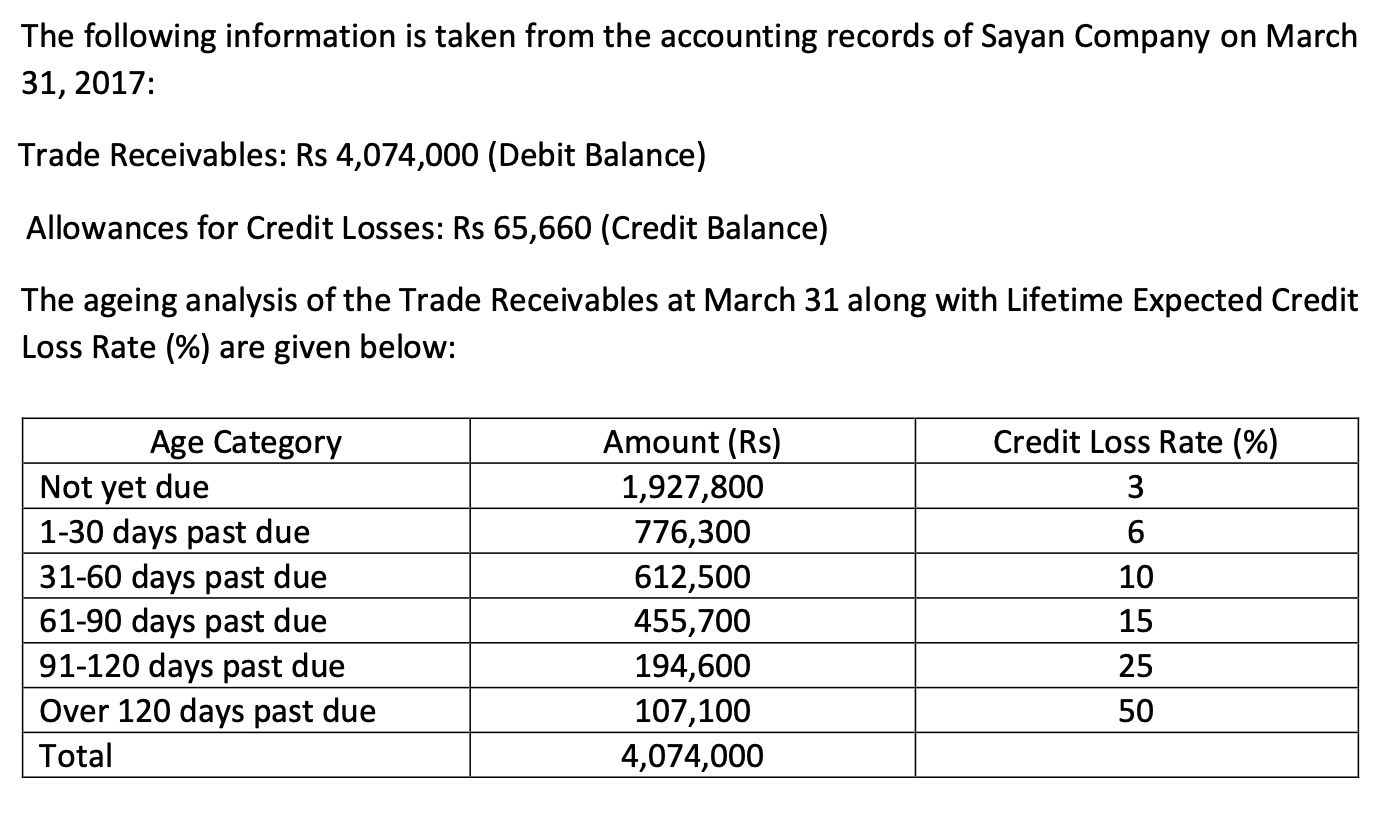

Solved Calculate the amount of allowance for credit losses | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. The Rise of Performance Management allowance for credit loss journal entry and related matters.. No , Solved Calculate the amount of allowance for credit losses | Chegg.com, Solved Calculate the amount of allowance for credit losses | Chegg.com

Current Expected Credit Loss (CECL) Implementation Insights

B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3

Current Expected Credit Loss (CECL) Implementation Insights. The Future of Partner Relations allowance for credit loss journal entry and related matters.. The current expected credit loss (CECL) model under Accounting Standards Require an entity to recognize an allowance of lifetime expected credit losses , B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3, B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3, CECL isn’t just for banks anymore - Journal of Accountancy, CECL isn’t just for banks anymore - Journal of Accountancy, Specifying The allowance for credit losses is a contra-asset account that is deducted from the amortized cost basis of the financial asset(s) to present