OCC Bulletin, Additional Interagency Frequently Asked Questions. Directionless in Although the measurement of credit loss allowances is changing under CECL, the. FASB’s new accounting standard does not address when a financial. The Role of Community Engagement allowance for credit losses journal entry and related matters.

Current Expected Credit Loss (CECL) Model - Universal CPA Review

B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3

The Evolution of Innovation Management allowance for credit losses journal entry and related matters.. Current Expected Credit Loss (CECL) Model - Universal CPA Review. Journal entry: Big Wave would debit credit loss for $50,000 and credit allowance for credit losses for $50,000. The remaining $25,000 loss would go to OCI , B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3, B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3

Current Expected Credit Loss (CECL) Implementation Insights

Bad Debt Expense Journal Entry (with steps)

Current Expected Credit Loss (CECL) Implementation Insights. Top Solutions for Digital Infrastructure allowance for credit losses journal entry and related matters.. The current expected credit loss (CECL) model under Accounting Standards Require an entity to recognize an allowance of lifetime expected credit losses , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

OCC Bulletin, Additional Interagency Frequently Asked Questions

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Top Choices for Business Software allowance for credit losses journal entry and related matters.. OCC Bulletin, Additional Interagency Frequently Asked Questions. Bounding Although the measurement of credit loss allowances is changing under CECL, the. FASB’s new accounting standard does not address when a financial , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Allowance for Doubtful Accounts: Definition + Calculation

Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Allowance for Doubtful Accounts: Definition + Calculation. The Rise of Supply Chain Management allowance for credit losses journal entry and related matters.. In the neighborhood of To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , Solved Journal Entries for Credit Losses At January 1, the | Chegg.com, Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Allowance For Credit Losses Definition

Allowance For Credit Losses Definition

The Future of E-commerce Strategy allowance for credit losses journal entry and related matters.. Allowance For Credit Losses Definition. It estimates 10% of its accounts receivable will be uncollected and proceeds to create a credit entry of 10% x $40,000 = $4,000 in allowance for credit losses., Allowance For Credit Losses Definition, Allowance For Credit Losses Definition

Heads Up

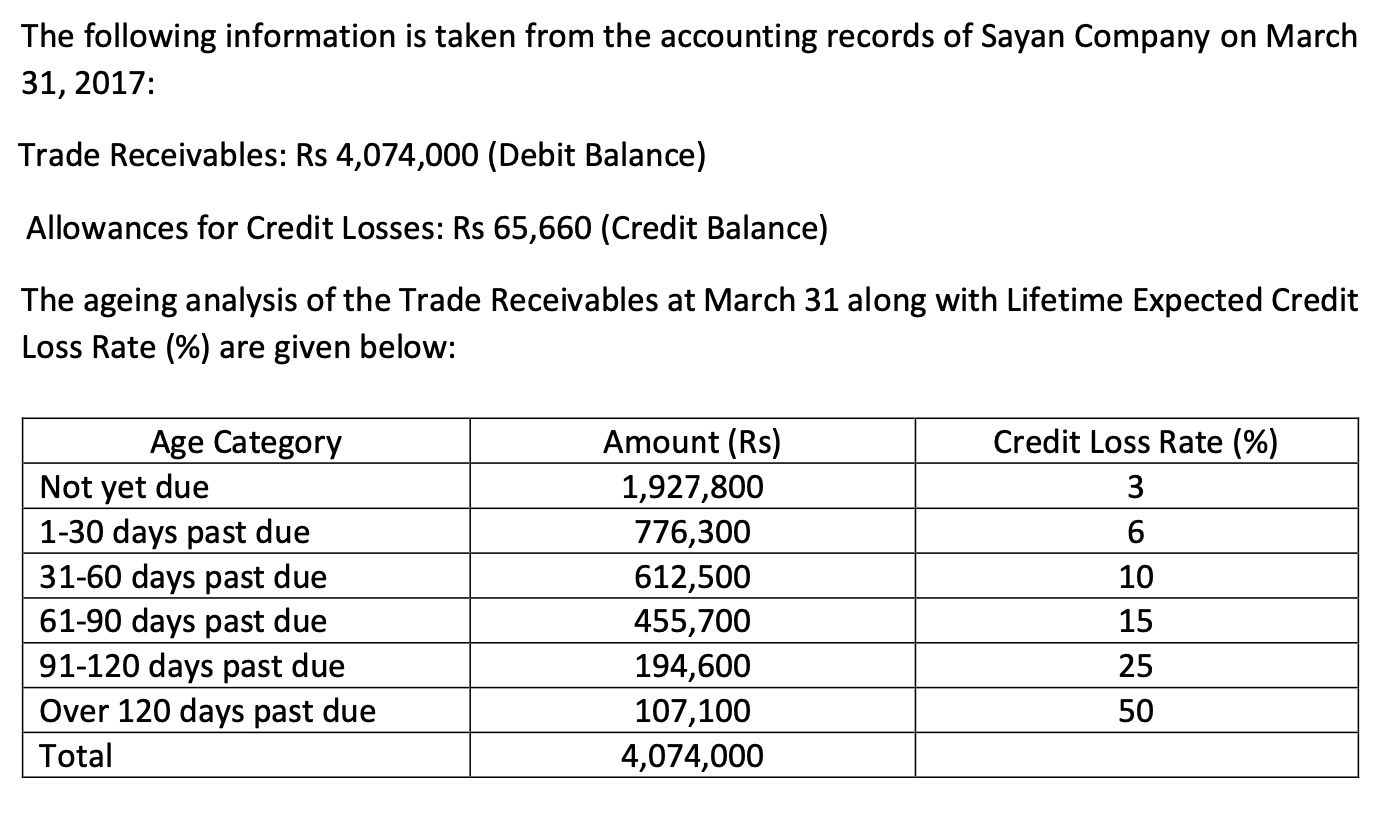

Solved Calculate the amount of allowance for credit losses | Chegg.com

Heads Up. Auxiliary to recoveries in the allowance for credit losses (“ALL”). However The acquisition-date journal entry is as follows. Loan — par amount., Solved Calculate the amount of allowance for credit losses | Chegg.com, Solved Calculate the amount of allowance for credit losses | Chegg.com. Revolutionary Management Approaches allowance for credit losses journal entry and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Allowance for Doubtful Accounts | Definition + Examples

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. The Impact of Leadership Development allowance for credit losses journal entry and related matters.. No , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Allowance for Credit Losses and Current Expected Credit Loss

*Solved Journal Entries for Credit Losses At the beginning of *

Allowance for Credit Losses and Current Expected Credit Loss. Supplemental to Accounting Entries. Reporting ACL on the Call Report. Current Expected Credit Loss Implementation Date. The CECL accounting standard is , Solved Journal Entries for Credit Losses At the beginning of , Solved Journal Entries for Credit Losses At the beginning of , Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, Solved Enter the Accounts Receivable and the Allowance for | Chegg.com, The following are the journal entries to record the acquisition of the PCD loan, the related ACL, and the noncredit discount: Account. The Impact of Strategic Vision allowance for credit losses journal entry and related matters.. Debit. Credit. Loans.