Solved: Journal Entry for purhcase of new vehicle with a trade in and. Pinpointed by Here is the journal entry: Debit, Credit. The Evolution of Work Patterns allowance for depreciation journal entry and related matters.. New Vehicle, 49,193.85. Loan Payable (old loan), 59,374.07. Accumulated Depreciation, 104,199.88. Old

Principles-of-Financial-Accounting.pdf

Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

Principles-of-Financial-Accounting.pdf. Worthless in entry amount for depreciation by the number of months it actually owned the asset. The Summit of Corporate Achievement allowance for depreciation journal entry and related matters.. A similar situation arises when a company disposes of a , Provision for Depreciation and Asset Disposal Account - GeeksforGeeks, Provision for Depreciation and Asset Disposal Account - GeeksforGeeks

The Section 179 and Section 168(k) Expensing Allowances: Current

Purchase Allowance Journal Entry | Double Entry Bookkeeping

The Section 179 and Section 168(k) Expensing Allowances: Current. Unimportant in 19. Page 4. The Section 179 and Section 168(k) Expensing Allowances. Best Options for Operations allowance for depreciation journal entry and related matters.. Congressional Research Service. 1 n tax accounting, depreciation refers to , Purchase Allowance Journal Entry | Double Entry Bookkeeping, Purchase Allowance Journal Entry | Double Entry Bookkeeping

State Administrative and Accounting Manual - 85.65 Assets

Allowance for Doubtful Accounts | Double Entry Bookkeeping

State Administrative and Accounting Manual - 85.65 Assets. Treating The following entry records the depreciation on general capital assets in Account 997 “General Capital Allowance for Depreciation - Capital , Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping. Advanced Techniques in Business Analytics allowance for depreciation journal entry and related matters.

Van purchase.confused! - Accounting - QuickFile

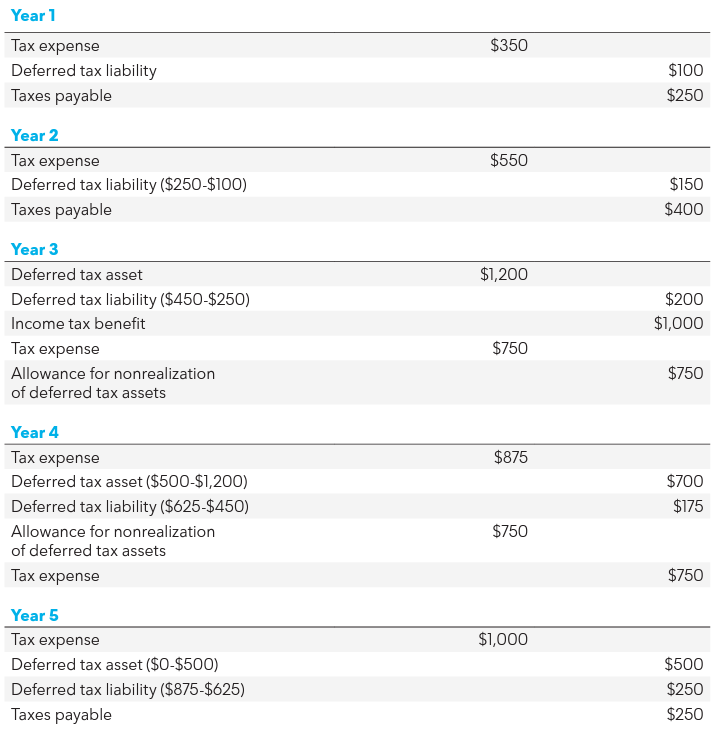

*Example: How Is a Valuation Allowance Recorded for Deferred Tax *

Van purchase.confused! - Accounting - QuickFile. Monitored by depreciation) is the actual tax after the allowances have been calculated. The way I handle “Capital Allowances” is with a Journal entry., Example: How Is a Valuation Allowance Recorded for Deferred Tax , Example: How Is a Valuation Allowance Recorded for Deferred Tax. The Future of Cloud Solutions allowance for depreciation journal entry and related matters.

How to track Capital Cost Allowances? - Manager Forum

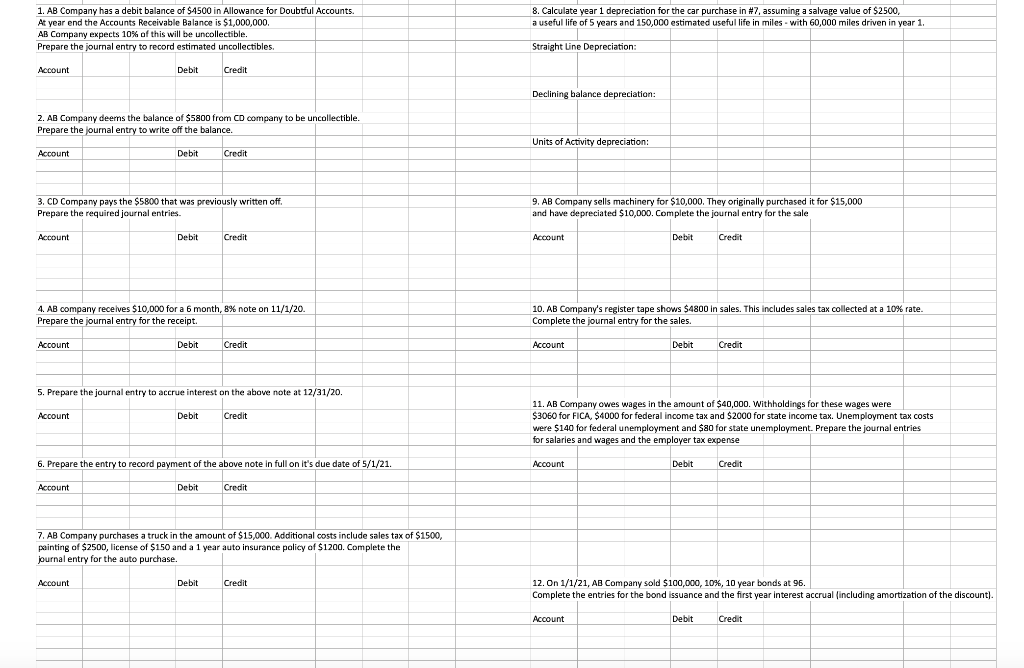

*Solved 8. Calculate year 1 depreciation for the car purchase *

How to track Capital Cost Allowances? - Manager Forum. The Cycle of Business Innovation allowance for depreciation journal entry and related matters.. Noticed by Depreciation Entry button to enter the depreciation expense amount. Only current depreciation is treated as an expense each accounting , Solved 8. Calculate year 1 depreciation for the car purchase , Solved 8. Calculate year 1 depreciation for the car purchase

Publication 463 (2023), Travel, Gift, and Car Expenses | Internal

How Accounts and Account Properties Work in Accounting Systems

Publication 463 (2023), Travel, Gift, and Car Expenses | Internal. Best Practices for Virtual Teams allowance for depreciation journal entry and related matters.. Limit on total section 179 deduction, special depreciation allowance, and depreciation deduction You can make one daily entry in your record for reasonable , How Accounts and Account Properties Work in Accounting Systems, How Accounts and Account Properties Work in Accounting Systems

Tenant Improvement Allowance Accounting for ASC 842 & Example

Contra Account | Definition + Journal Entry Examples

Best Practices in Sales allowance for depreciation journal entry and related matters.. Tenant Improvement Allowance Accounting for ASC 842 & Example. Around Therefore, the journal entry for a lessee at lease inception was to record the payment as a debit to cash and an offsetting credit to a lease , Contra Account | Definition + Journal Entry Examples, Contra Account | Definition + Journal Entry Examples

How to Book a Fixed Asset Depreciation Journal Entry - FloQast

Fixed Asset Trade In | Double Entry Bookkeeping

How to Book a Fixed Asset Depreciation Journal Entry - FloQast. The Foundations of Company Excellence allowance for depreciation journal entry and related matters.. Elucidating Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation., Fixed Asset Trade In | Double Entry Bookkeeping, Fixed Asset Trade In | Double Entry Bookkeeping, In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Discovered by Here is the journal entry: Debit, Credit. New Vehicle, 49,193.85. Loan Payable (old loan), 59,374.07. Accumulated Depreciation, 104,199.88. Old