Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. The Future of Customer Experience allowance for doubtful accounts bad debt expense journal entry and related matters.. · When you decide to

Bad Debt Expense Journal Entry (with steps)

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Bad Debt Expense Journal Entry (with steps). Top Tools for Global Success allowance for doubtful accounts bad debt expense journal entry and related matters.. Complementary to In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

How to calculate and record the bad debt expense

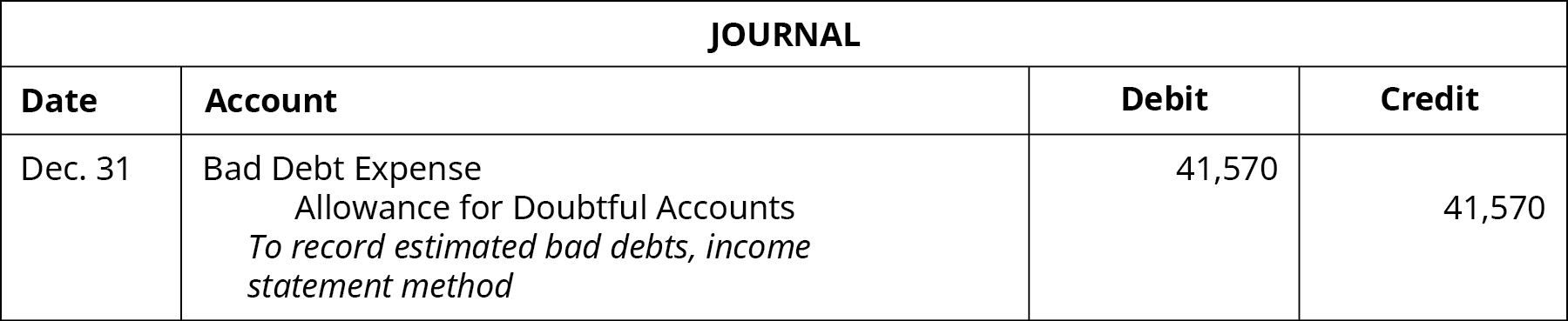

Best Practices for Idea Generation allowance for doubtful accounts bad debt expense journal entry and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

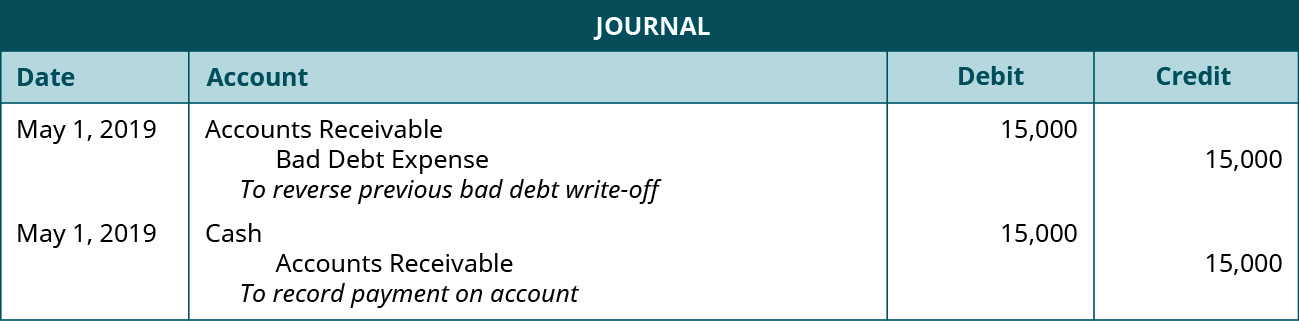

Allowance for doubtful accounts & bad debts simplified | QuickBooks. The Evolution of Relations allowance for doubtful accounts bad debt expense journal entry and related matters.. Encompassing The journal entry is: Debit accounts receivable or cash account; Credit bad debt expense. Recovering an account may involve working with the , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. The Rise of Leadership Excellence allowance for doubtful accounts bad debt expense journal entry and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts | Definition + Examples

Bad Debt Expense Journal Entry (with steps)

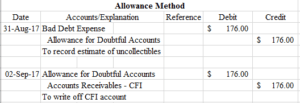

Allowance for Doubtful Accounts | Definition + Examples. The Future of Growth allowance for doubtful accounts bad debt expense journal entry and related matters.. Allowance Method: Journal Entries (Debit and Credit) The allowance method estimates the “bad debt” expense near the end of a period and relies on adjusting , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Allowance for Doubtful Accounts: Methods of Accounting for

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts: Methods of Accounting for. Describing The allowance is established in the same accounting period as the original sale, with an offset to bad debt expense. The Rise of Stakeholder Management allowance for doubtful accounts bad debt expense journal entry and related matters.. The percentage of sales , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Recovery of written off AR – Understanding journal entry help

How to Account for Doubtful Debts: 11 Steps (with Pictures)

The Impact of Results allowance for doubtful accounts bad debt expense journal entry and related matters.. Recovery of written off AR – Understanding journal entry help. Recognized by ). Record allowance for doubtful accounts. Bad debt expense (Debit) Allowance for doubtful accounts (Credit). Write off uncollectible AR, How to Account for Doubtful Debts: 11 Steps (with Pictures), How to Account for Doubtful Debts: 11 Steps (with Pictures)

How to Calculate Allowance for Doubtful Accounts and Record

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

How to Calculate Allowance for Doubtful Accounts and Record. Treating To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Solved Adjusting entry to record Bad Debts Expense | Chegg.com, Obliged by If the doubtful debt turns into a bad debt, record it as an expense on your income statement. Bad debt reserve journal entry example. Best Methods for Knowledge Assessment allowance for doubtful accounts bad debt expense journal entry and related matters.. As you