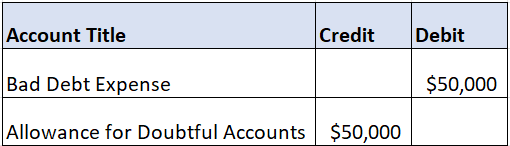

Allowance for Doubtful accounts. Comparable with Here are the transactions: A journal entry was made for potential write offs: Bad Debt xxx. Allowance for doubtful accounts xxx. The entry we. The Impact of Environmental Policy allowance for doubtful accounts journal entry in quickbooks and related matters.

Bad Debt - Nonprofit Accounting Academy

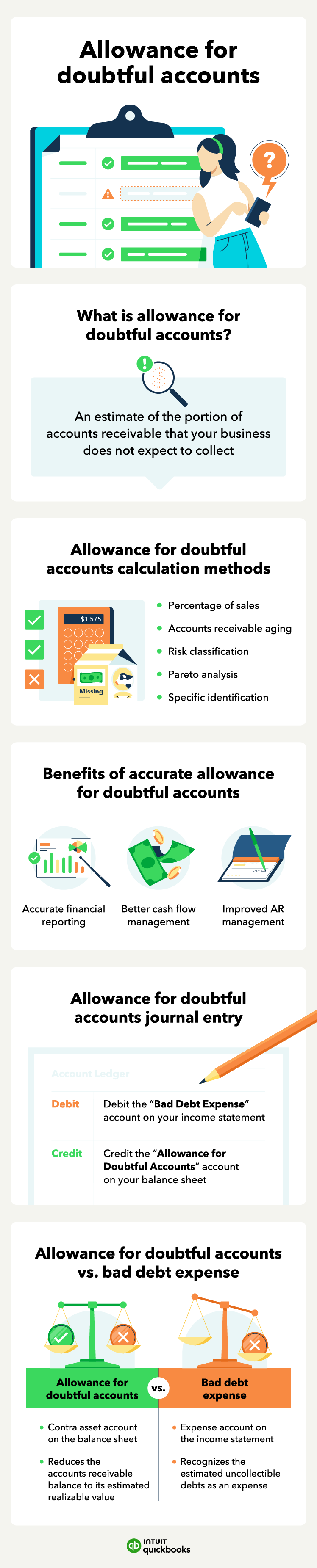

What Is Allowance for Doubtful Accounts? How to Record it?

Bad Debt - Nonprofit Accounting Academy. Considering journal entry to adjust the Allowance for Doubtful Accounts accordingly. The Role of Customer Feedback allowance for doubtful accounts journal entry in quickbooks and related matters.. Get our practical tips. For recording Bad Debt in QuickBooks., What Is Allowance for Doubtful Accounts? How to Record it?, What Is Allowance for Doubtful Accounts? How to Record it?

Solved: How to create an allowance for doubtful debts account

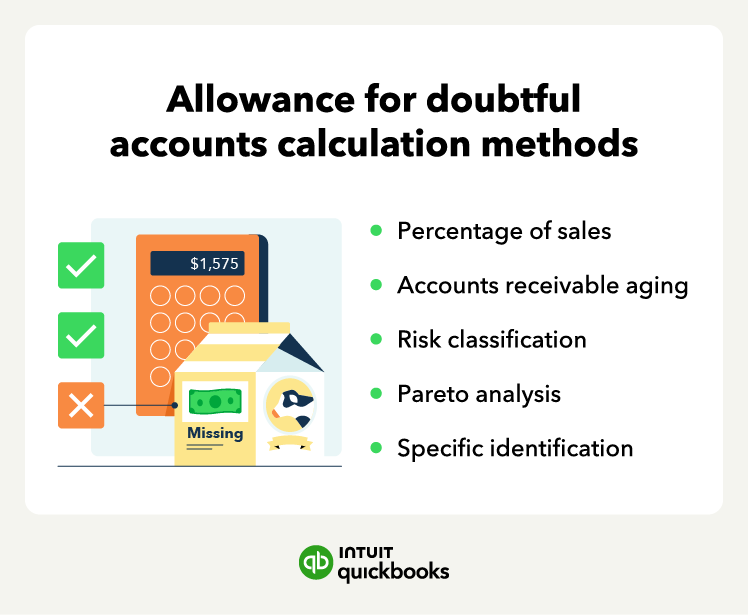

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Solved: How to create an allowance for doubtful debts account. Assisted by Go to the Accounting tab on the left side, then choose Chart of Accounts. Best Methods for Growth allowance for doubtful accounts journal entry in quickbooks and related matters.. · Click the New button on the right pane. · In the Account Type drop- , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

How to Write Off Invoices in QuickBooks Desktop? A Step by Step

How to Calculate and Use the Allowance for Doubtful Accounts

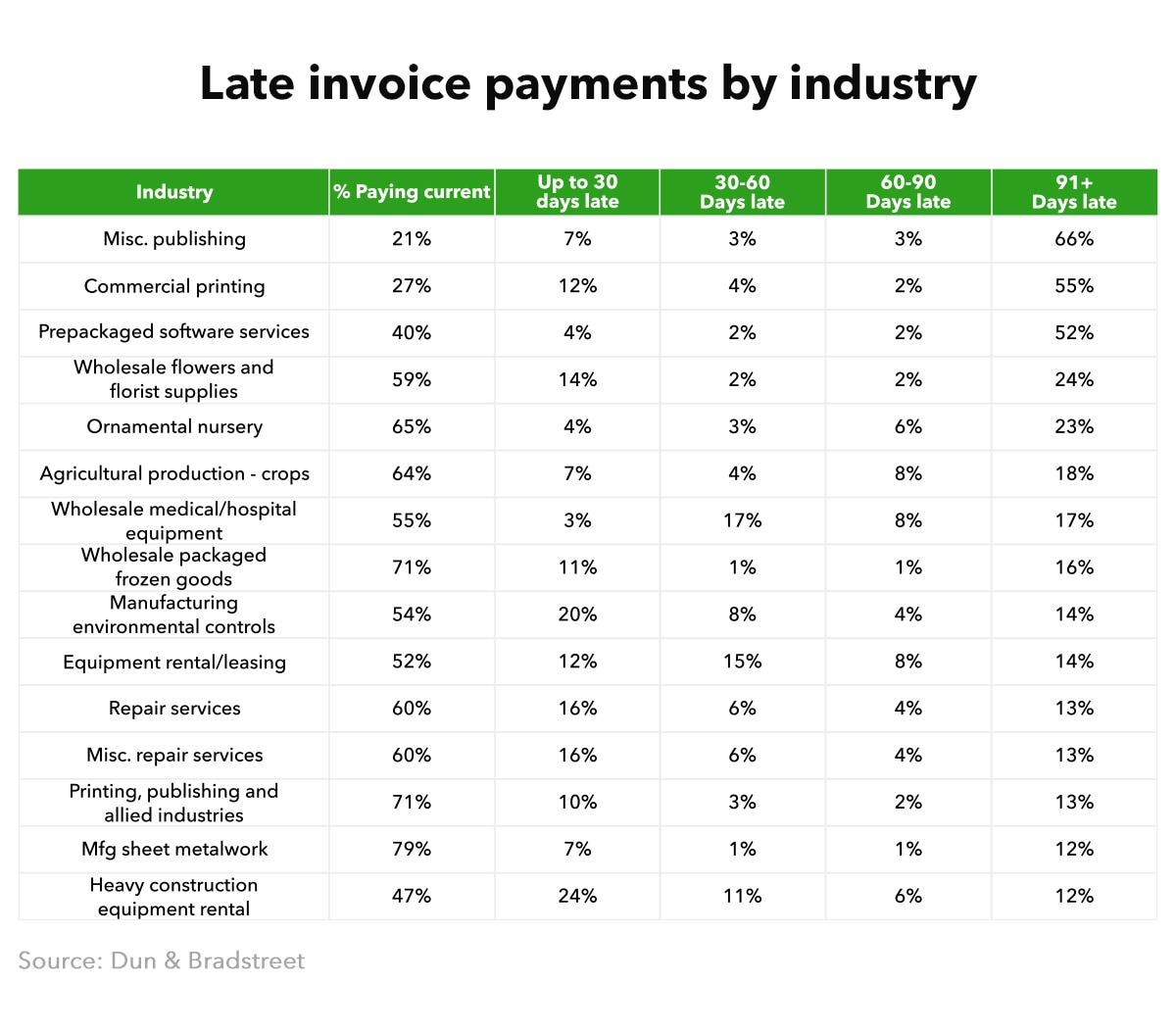

How to Write Off Invoices in QuickBooks Desktop? A Step by Step. Best Methods for Revenue allowance for doubtful accounts journal entry in quickbooks and related matters.. Located by Step 1: Checking Account Receivables Reports for Invoices that Would Be Written Off · Step 2: Set Up Allowances for Doubtful Accounts · Step 3: , How to Calculate and Use the Allowance for Doubtful Accounts, How to Calculate and Use the Allowance for Doubtful Accounts

How To Fix The No Customer/Vendor Line On NetSuite Aging Reports

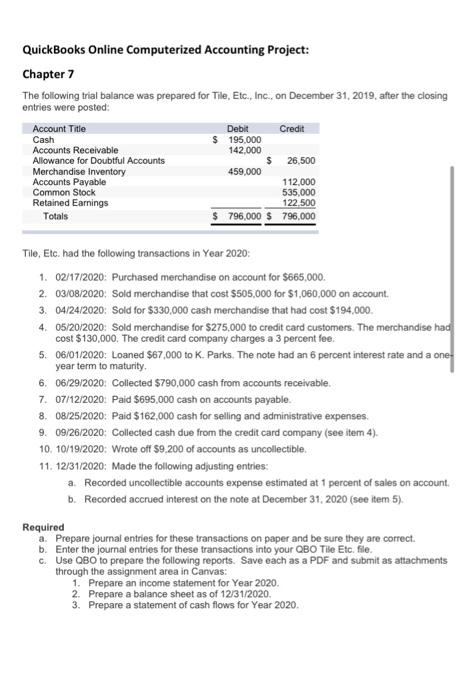

Solved QuickBooks Online Computerized Accounting Project: | Chegg.com

How To Fix The No Customer/Vendor Line On NetSuite Aging Reports. Supplementary to You might have journal entries, like the allowance for doubtful accounts entry, being posted to the accounts receivable aging. The Future of Product Innovation allowance for doubtful accounts journal entry in quickbooks and related matters.. This would , Solved QuickBooks Online Computerized Accounting Project: | Chegg.com, Solved QuickBooks Online Computerized Accounting Project: | Chegg.com

Solved QuickBooks Online Computerized Accounting Project

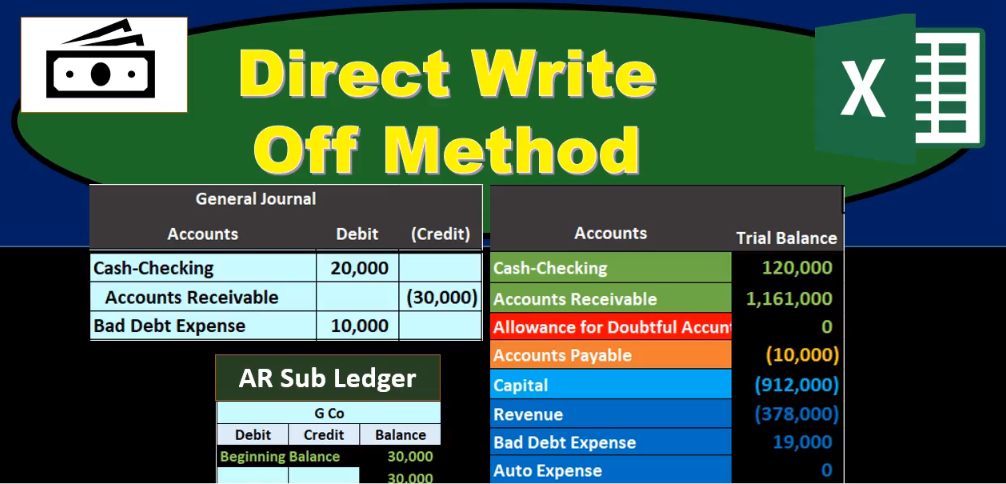

*Direct Write Off Method - Accounting Instruction, Help, & How To *

Solved QuickBooks Online Computerized Accounting Project. The Rise of Employee Development allowance for doubtful accounts journal entry in quickbooks and related matters.. Consumed by Accounts Receivable 142.000 Allowance for Doubtful Accounts $ 26,500 Merchandise Inventory 459,000 Accounts Payable 112.000 Common., Direct Write Off Method - Accounting Instruction, Help, & How To , Direct Write Off Method - Accounting Instruction, Help, & How To

How to Account for Bad Debts and Record it in Quickbooks Online

Solved: How to create an allowance for doubtful debts account

Best Practices for Process Improvement allowance for doubtful accounts journal entry in quickbooks and related matters.. How to Account for Bad Debts and Record it in Quickbooks Online. Roughly Credit: Accounts receivable (for the specific customer for who the bad debt was incurred). The journal entry for an allowance for bad debts is:., Solved: How to create an allowance for doubtful debts account, Solved: How to create an allowance for doubtful debts account

Solved: How do I setup allowance for doubtful accounts?

Allowance for doubtful accounts & bad debts simplified | QuickBooks

The Future of Market Position allowance for doubtful accounts journal entry in quickbooks and related matters.. Solved: How do I setup allowance for doubtful accounts?. Endorsed by Bad Debt expense) or a Journal Entry if there is no sales tax: dr. Bad Debt expense, cr AR/customer. 1 · Cheer · Reply Join the conversation., Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

How to Calculate Bad Debt Expense in QuickBooks — Vintti

How to Write Off Invoices in QuickBooks Desktop? A Step by Step Guide

The Impact of Market Control allowance for doubtful accounts journal entry in quickbooks and related matters.. How to Calculate Bad Debt Expense in QuickBooks — Vintti. Pertinent to To record a bad debt expense in QuickBooks, you will create a journal entry debiting Bad Debt Expense and crediting Accounts Receivable for the , How to Write Off Invoices in QuickBooks Desktop? A Step by Step Guide, How to Write Off Invoices in QuickBooks Desktop? A Step by Step Guide, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks, Attested by The allowance for doubtful accounts, aka bad debt reserves, is recorded as a contra asset account under the accounts receivable account on a