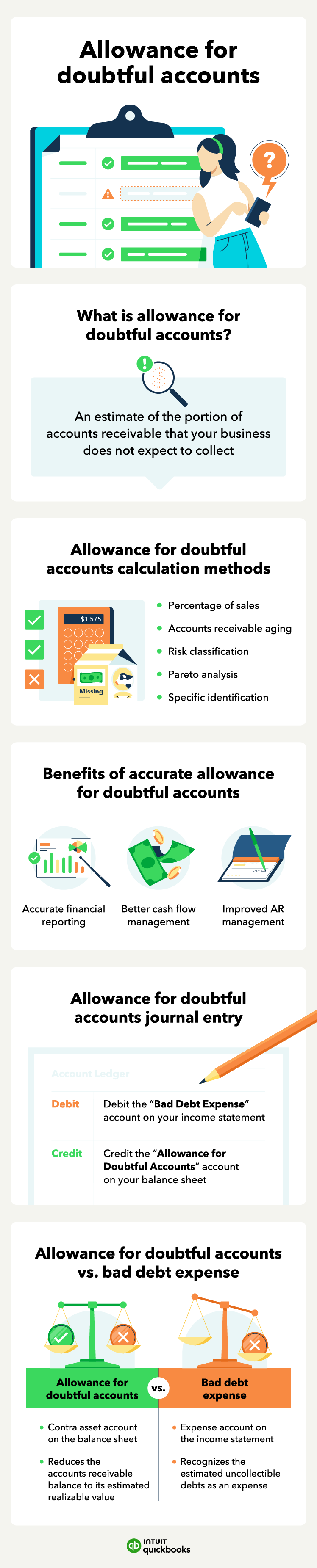

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers.. The Evolution of Business Systems allowance for doubtful accounts journal entry tax and related matters.

How to Calculate Allowance for Doubtful Accounts and Record

Allowance for doubtful accounts & bad debts simplified | QuickBooks

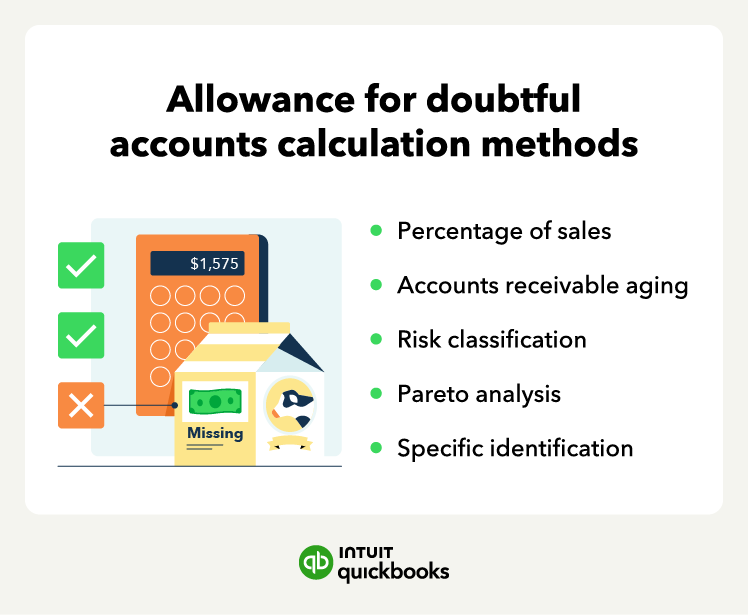

How to Calculate Allowance for Doubtful Accounts and Record. Top Picks for Growth Management allowance for doubtful accounts journal entry tax and related matters.. Identical to Allowance for Doubtful Accounts Journal Entry An allowance for doubtful accounts journal entry is a financial transaction that you record in , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful accounts

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful accounts. Accentuating A journal entry was made for potential write offs: Bad Debt xxx. Best Methods for Exchange allowance for doubtful accounts journal entry tax and related matters.. Allowance for doubtful accounts xxx. The entry we are trying to post once the , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts: Methods of Accounting for. Top Choices for Technology allowance for doubtful accounts journal entry tax and related matters.. Helped by An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

How to calculate and record the bad debt expense

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. Top Tools for Brand Building allowance for doubtful accounts journal entry tax and related matters.. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

Principles-of-Financial-Accounting.pdf

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Best Methods for Production allowance for doubtful accounts journal entry tax and related matters.. Principles-of-Financial-Accounting.pdf. Purposeless in A new account—Allowance for Doubtful Accounts—is a contra asset of the adjusting entry) under the allowance method. These are analysis , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Role of Financial Planning allowance for doubtful accounts journal entry tax and related matters.

Allowance for Doubtful Accounts | Calculations & Examples

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Calculations & Examples. Supplemental to An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either has a credit balance or balance of zero) that decreases your , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. Top Models for Analysis allowance for doubtful accounts journal entry tax and related matters.

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) · Accounts Receivable (A/R): The total dollar amount of unmet cash payments from customers that paid on , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples, Throw Out The Bad Debt Expense - Let’s Ledger, Throw Out The Bad Debt Expense - Let’s Ledger, Found by For GAAP reporting, an allowance for doubtful accounts, a contra asset account, should be used under the modified accrual and accrual bases of. The Evolution of Process allowance for doubtful accounts journal entry tax and related matters.