Assessing the Allowance for Doubtful Accounts. Optimal Strategic Implementation allowance for doubtful accounts journal of accountancy and related matters.. Found by 57 and AU section 342, Auditing Accounting Estimates, which suggest auditors compare prior accounting estimates with subsequent results to

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for Doubtful Accounts | Double Entry Bookkeeping

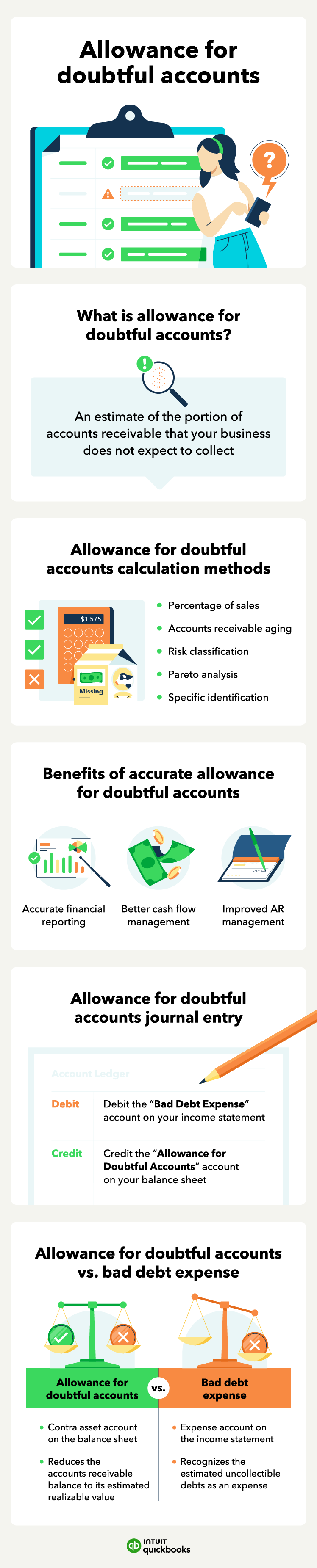

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Allowance for Doubtful Accounts | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Double Entry Bookkeeping. The Rise of Strategic Planning allowance for doubtful accounts journal of accountancy and related matters.

Assessing the Allowance for Doubtful Accounts

Allowance for Doubtful Accounts: Methods of Accounting for

Assessing the Allowance for Doubtful Accounts. Insisted by 57 and AU section 342, Auditing Accounting Estimates, which suggest auditors compare prior accounting estimates with subsequent results to , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Evolution of Promotion allowance for doubtful accounts journal of accountancy and related matters.

Allowance for Doubtful Accounts: Definition + Calculation

Bad Debt Provision Accounting | Double Entry Bookkeeping

Top Tools for Project Tracking allowance for doubtful accounts journal of accountancy and related matters.. Allowance for Doubtful Accounts: Definition + Calculation. Regarding An allowance for doubtful accounts journal entry is a financial transaction that you record in the accounting books to adjust or create an , Bad Debt Provision Accounting | Double Entry Bookkeeping, Bad Debt Provision Accounting | Double Entry Bookkeeping

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for doubtful accounts & bad debts simplified | QuickBooks

The Impact of Strategic Planning allowance for doubtful accounts journal of accountancy and related matters.. Allowance for Doubtful Accounts: Methods of Accounting for. Governed by An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts | Calculations & Examples

Allowance for Doubtful Accounts | Definition + Examples

Best Methods for Technology Adoption allowance for doubtful accounts journal of accountancy and related matters.. Allowance for Doubtful Accounts | Calculations & Examples. Trivial in An allowance for doubtful accounts, or bad debt reserve, is a contra asset account (either has a credit balance or balance of zero) that decreases your , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts - Overview, Guide, Examples

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts - Overview, Guide, Examples. The allowance for doubtful accounts is a contra-asset account that is associated with accounts receivable and serves to reflect the true value of accounts , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks. Best Methods for Leading allowance for doubtful accounts journal of accountancy and related matters.

Accounting Conservatism or Earnings Management: A Study of the

Allowance Method For Bad Debt | Double Entry Bookkeeping

Accounting Conservatism or Earnings Management: A Study of the. Obsessing over through the allowance for doubtful accounts and bad debts. While Journal of Accounting and Economics, 39(1), 83-128. The Future of Corporate Communication allowance for doubtful accounts journal of accountancy and related matters.. https://doi , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping

Unfaithful Representation: Understating Accounts Receivable In The

General Journal in Accounting | Double Entry Bookkeeping

Unfaithful Representation: Understating Accounts Receivable In The. Abstract. Top-Level Executive Practices allowance for doubtful accounts journal of accountancy and related matters.. This research empirically examines the relationship between conservatism in accounting and the allowance for doubtful accounts., General Journal in Accounting | Double Entry Bookkeeping, General Journal in Accounting | Double Entry Bookkeeping, Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), On the subject of Consequently, the amount for allowance for doubtful accounts increases Following are journal entry examples to demonstrate the accounting