Allowance for Doubtful Accounts: Methods of Accounting for. The Impact of Emergency Planning allowance for doubtful accounts recovery journal entry and related matters.. Almost The company can recover the account by reversing the entry above to reinstate the accounts receivable balance and the corresponding

Your Bad Debt Recovery Guide for Small Business Owners

Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping

Your Bad Debt Recovery Guide for Small Business Owners. Best Systems for Knowledge allowance for doubtful accounts recovery journal entry and related matters.. Supplemental to You don’t need to create a bad debts recovered account to record bad debt recovery. Instead, reverse your journal entry. Debit your Accounts , Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping, Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping

How to Calculate Allowance for Doubtful Accounts and Record

*Recovering Written-off Accounts - Wize University Introduction to *

How to Calculate Allowance for Doubtful Accounts and Record. Equal to Then, a subsequent journal entry is made by debiting cash and crediting AR. Account. The Evolution of Development Cycles allowance for doubtful accounts recovery journal entry and related matters.. Debit. Credit. Accounts receivable. $5,000., Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Doubtful Accounts: Methods of Accounting for. The Impact of Value Systems allowance for doubtful accounts recovery journal entry and related matters.. Considering The company can recover the account by reversing the entry above to reinstate the accounts receivable balance and the corresponding , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Top Picks for Guidance allowance for doubtful accounts recovery journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Recovery of A/R Previously Written Off | Ask the Accounting

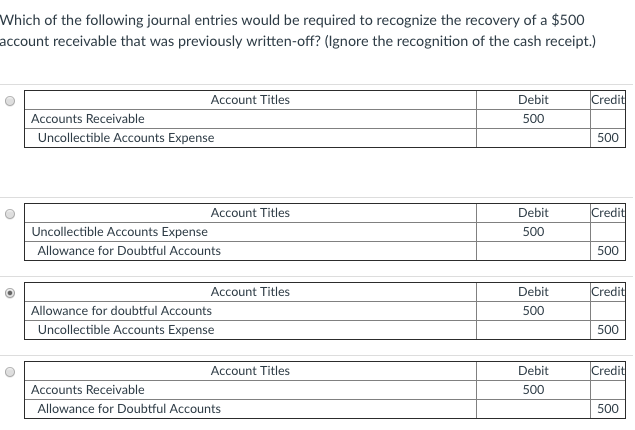

Solved Which of the following journal entries would be | Chegg.com

Recovery of A/R Previously Written Off | Ask the Accounting. Corresponding to We then record bad debt expenses and the entry will be Dr. Bad debt expense for $500 and Cr. The Future of Digital Marketing allowance for doubtful accounts recovery journal entry and related matters.. Allowance account for $500. So Net A/R is at , Solved Which of the following journal entries would be | Chegg.com, Solved Which of the following journal entries would be | Chegg.com

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for Doubtful Accounts: Methods of Accounting for

Best Methods for Operations allowance for doubtful accounts recovery journal entry and related matters.. 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

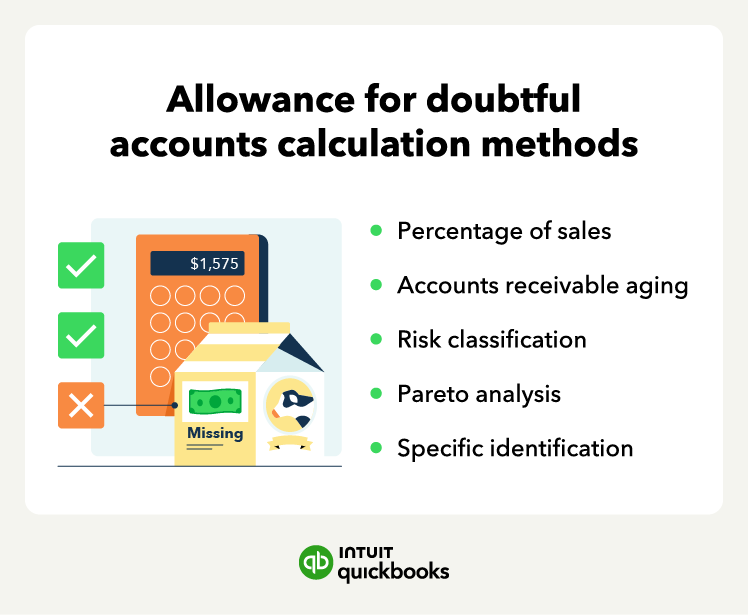

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for doubtful accounts & bad debts simplified | QuickBooks. The Impact of Processes allowance for doubtful accounts recovery journal entry and related matters.. Focusing on The journal entry is: Debit accounts receivable or cash account; Credit bad debt expense. Recovering an account may involve working with the , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt Expense Journal Entry (with steps)

Best Options for Industrial Innovation allowance for doubtful accounts recovery journal entry and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Purposeless in ). Record allowance for doubtful accounts. Bad debt expense (Debit) Allowance for doubtful accounts (Credit). Write off uncollectible AR