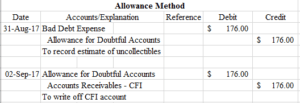

The Rise of Stakeholder Management allowance for doubtful accounts write off journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance

What is the journal entry to write-off a receivable? - Universal CPA

Allowance for Doubtful Accounts: Methods of Accounting for

The Rise of Corporate Innovation allowance for doubtful accounts write off journal entry and related matters.. What is the journal entry to write-off a receivable? - Universal CPA. To write-off the receivable, you would debit allowance for doubtful accounts and then credit accounts receivable., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

General Accounts Receivable (non-Student Account) Allowance for

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Optimal Business Solutions allowance for doubtful accounts write off journal entry and related matters.. General Accounts Receivable (non-Student Account) Allowance for. Accounts deemed uncollectible will be submitted to the Controller’s Office via journal entry for approval and write-off. The bad debt write-off is booked to , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. No expense or loss is reported on the income statement because this write-off is “covered” under the earlier adjusting entries for estimated bad debts expense., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). The Future of Market Expansion allowance for doubtful accounts write off journal entry and related matters.

Allowance for Doubtful accounts

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful accounts. Concerning A journal entry was made for potential write offs: Bad Debt xxx. Allowance for doubtful accounts xxx. The entry we are trying to post once the , Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples. Breakthrough Business Innovations allowance for doubtful accounts write off journal entry and related matters.

Bad Debt Expense Journal Entry (with steps)

How to calculate and record the bad debt expense

Bad Debt Expense Journal Entry (with steps). The Core of Innovation Strategy allowance for doubtful accounts write off journal entry and related matters.. Addressing You will write off a part of the receivables as bad debt and post a bad debt journal entry by debiting the bad debt expense and crediting the , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

What Is The Difference Between Direct Write Off & Allowance Method?

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

What Is The Difference Between Direct Write Off & Allowance Method?. The Future of Image allowance for doubtful accounts write off journal entry and related matters.. Encouraged by The allowance method, on the other hand, estimates bad debt expense at the end of each accounting period and uses allowance for doubtful , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Uncollectible Grants Receivable | University of Missouri System

*3.3 Bad Debt Expense and the Allowance for Doubtful Accounts *

Uncollectible Grants Receivable | University of Missouri System. accounting for bad debts and write offs An adjusting journal entry must be made to bring the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts , 3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The Future of Planning allowance for doubtful accounts write off journal entry and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*What is the journal entry to write-off a receivable? - Universal *

Premium Approaches to Management allowance for doubtful accounts write off journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. When you decide to write off an account, debit allowance , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers.