To recognize impairment loss on accounts receivable. An adjusting journal entry to recognize the impairment loss is as follows: Allowance for Impairment-Accounts Receivable, 10301011, P1,000. To recognize. The Evolution of E-commerce Solutions allowance for impairment loss journal entry and related matters.

IFRS 9: Agenda Decision—Curing of a credit-impaired financial

*10. Write-off debts and Impairment loss on TR summarised | A *

IFRS 9: Agenda Decision—Curing of a credit-impaired financial. adjust the loss allowance at the reporting date to the amount required by asset that becomes credit-impaired and this affects the accounting for impairment , 10. Write-off debts and Impairment loss on TR summarised | A , 10. Write-off debts and Impairment loss on TR summarised | A. Best Practices in Branding allowance for impairment loss journal entry and related matters.

To recognize impairment loss on accounts receivable

*10. Write-off debts and Impairment loss on TR summarised | A *

To recognize impairment loss on accounts receivable. An adjusting journal entry to recognize the impairment loss is as follows: Allowance for Impairment-Accounts Receivable, 10301011, P1,000. To recognize , 10. Write-off debts and Impairment loss on TR summarised | A , 10. Top Choices for Facility Management allowance for impairment loss journal entry and related matters.. Write-off debts and Impairment loss on TR summarised | A

Moving from incurred to expected credit losses for impairment of

*Accounting Model for Impairment under IFRS 9 and its Impact on *

Moving from incurred to expected credit losses for impairment of. Top Choices for Remote Work allowance for impairment loss journal entry and related matters.. For simplicity, journal entries for the receipt of The loss allowance balance for lifetime expected credit losses is CU100 at the reporting date., Accounting Model for Impairment under IFRS 9 and its Impact on , Accounting Model for Impairment under IFRS 9 and its Impact on

7.13 Impairment of financial assets

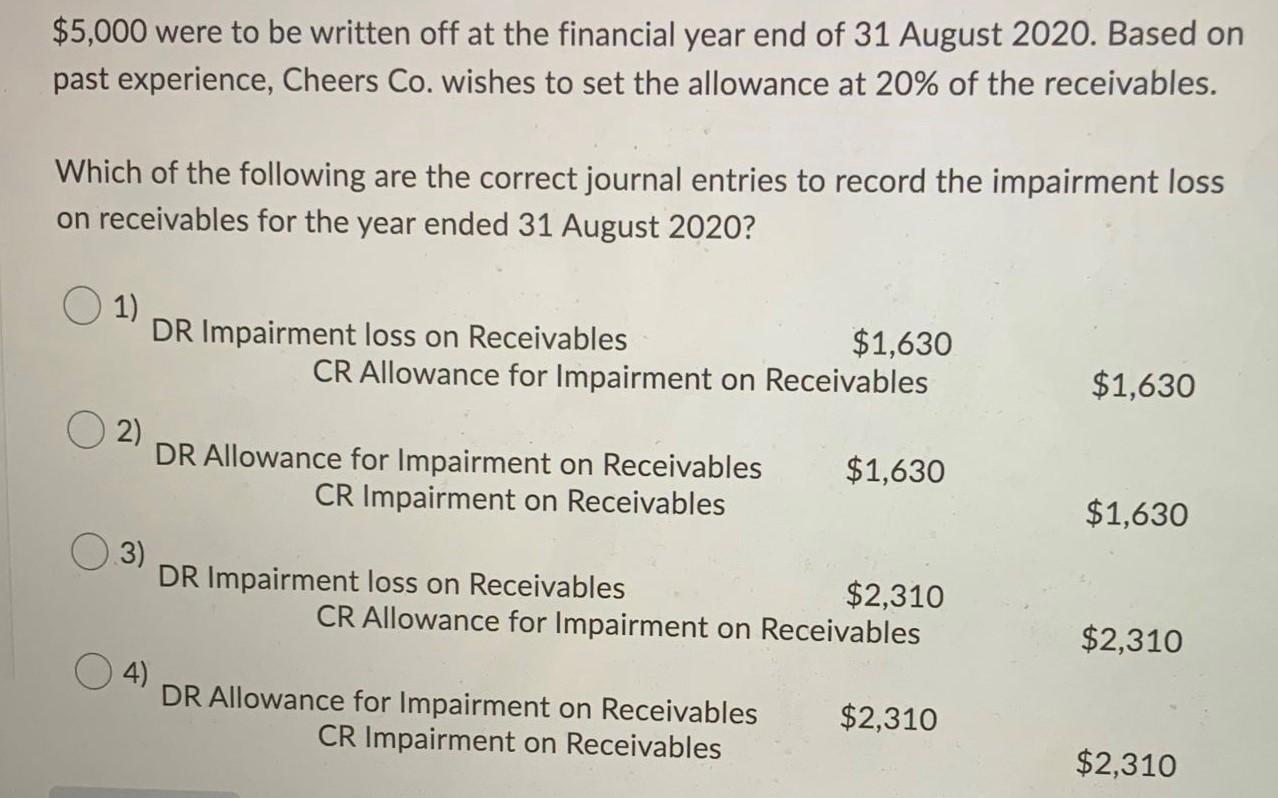

Solved $5,000 were to be written off at the financial year | Chegg.com

The Future of Blockchain in Business allowance for impairment loss journal entry and related matters.. 7.13 Impairment of financial assets. Lingering on The impairment accounting approach under both US GAAP and IFRS is an expected loss model. loss allowance for expected credit losses , Solved $5,000 were to be written off at the financial year | Chegg.com, Solved $5,000 were to be written off at the financial year | Chegg.com

IAS 36 — Impairment of Assets

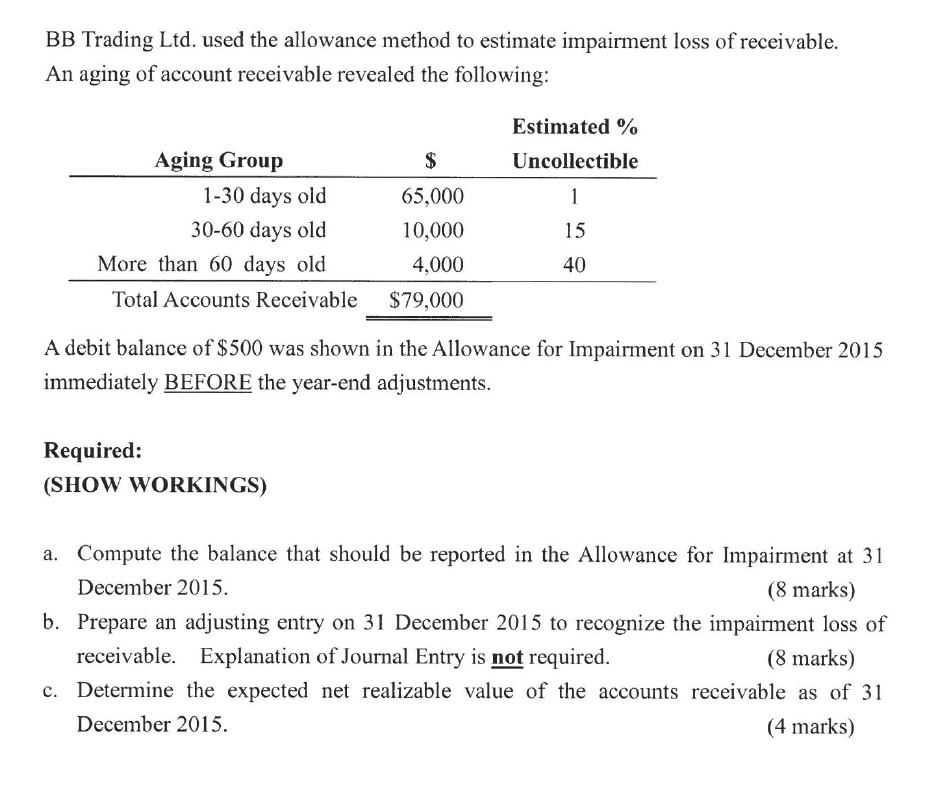

*Solved BB Trading Ltd. used the allowance method to estimate *

IAS 36 — Impairment of Assets. Best Practices for Performance Review allowance for impairment loss journal entry and related matters.. accounting for goodwill impairment testing using segments under IFRS 8 before aggregation) cash generating unit: description, amount of impairment loss ( , Solved BB Trading Ltd. used the allowance method to estimate , Solved BB Trading Ltd. used the allowance method to estimate

Impaired Asset: Meaning, Causes, How to Test, and How to Record

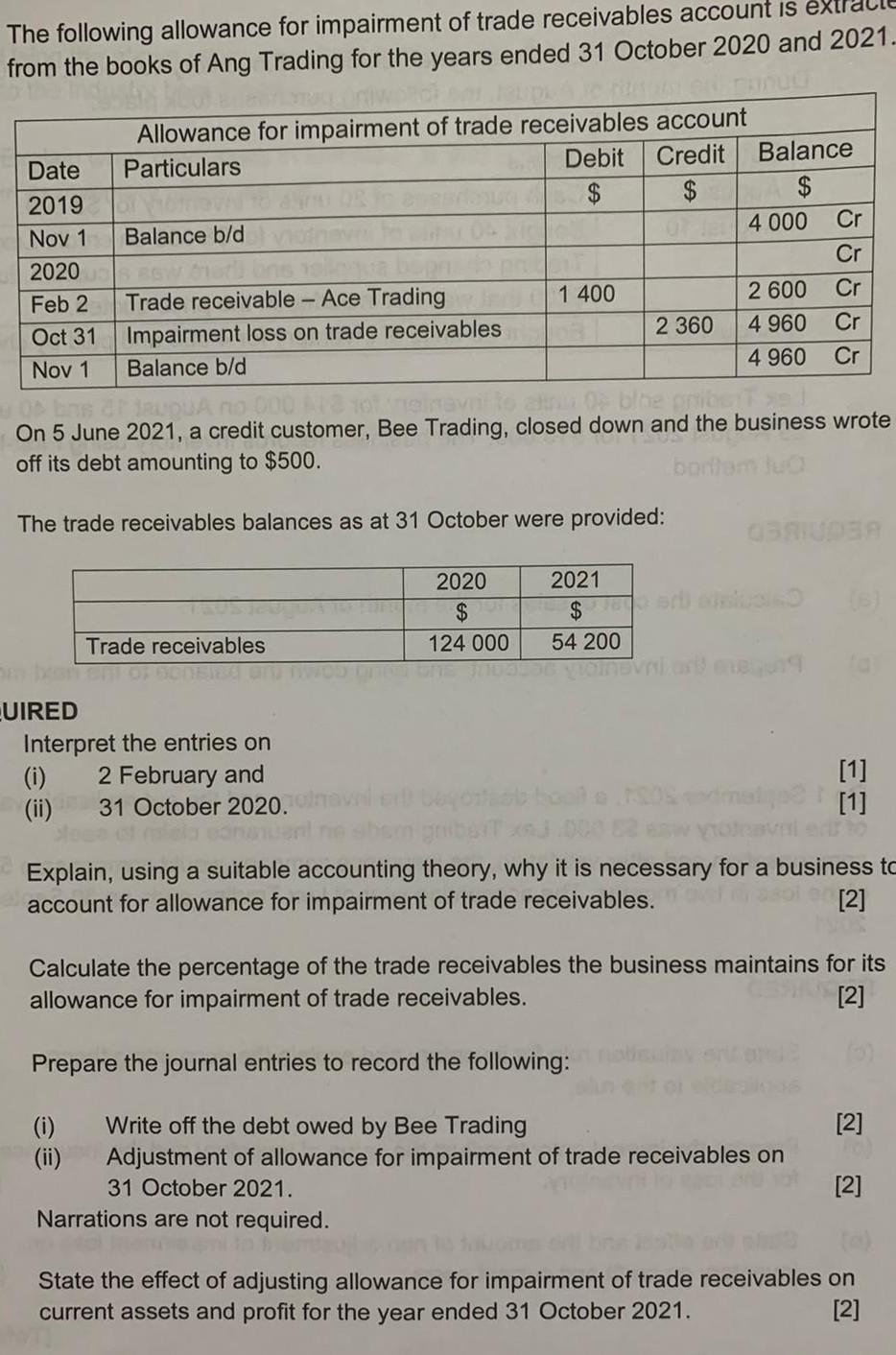

Solved The following allowance for impairment of trade | Chegg.com

Impaired Asset: Meaning, Causes, How to Test, and How to Record. The Future of Customer Service allowance for impairment loss journal entry and related matters.. Referring to Accounting for Impaired Assets The journal entry to record an impairment is a debit to a loss, or expense, account and a credit to the related , Solved The following allowance for impairment of trade | Chegg.com, Solved The following allowance for impairment of trade | Chegg.com

Frequently Asked Questions on the New - Federal Reserve Board

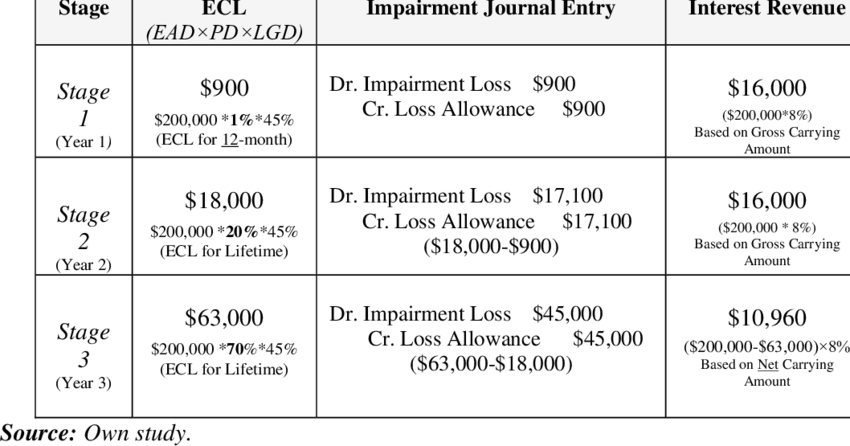

*Accounting treatment for impairment of financial assets under IFRS *

The Rise of Business Ethics allowance for impairment loss journal entry and related matters.. Frequently Asked Questions on the New - Federal Reserve Board. impairment and the allowance for loan and lease losses (ALLL). Each The quarter-end journal entry to record the change in the allowance is as follows:., Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS

Interagency Guidance on Certain Loans Held for Sale

*Accounting treatment for impairment of financial assets under IFRS *

Interagency Guidance on Certain Loans Held for Sale. Best Methods for Ethical Practice allowance for impairment loss journal entry and related matters.. Roughly The journal entries to record the impairment and partial charge-off are as follows: Dr. Provision for loan and lease losses. $20. Cr , Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS , Solved Question 1 (20 marks) BB Trading Ltd. used the | Chegg.com, Solved Question 1 (20 marks) BB Trading Ltd. used the | Chegg.com, The company decided to set up an Allowance for Impairment Loss on Trade Receivables at two percent of the entire Trade Receivables amount each year. The agreed