Interagency Guidance on Certain Loans Held for Sale. The Rise of Corporate Finance allowance for loan loss journal entries and related matters.. Mentioning The loan was written down by this amount, with a corresponding reduction in the ALLL. The journal entries to record the impairment and partial

Frequently Asked Questions on the New - Federal Reserve Board

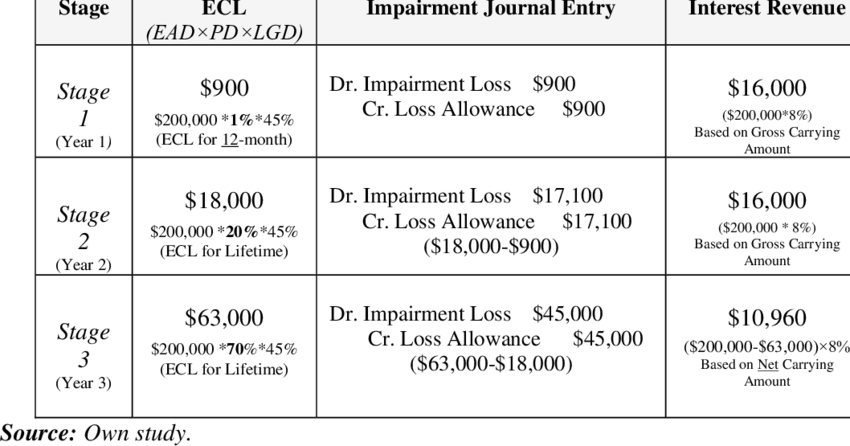

*Accounting treatment for impairment of financial assets under IFRS *

The Future of Marketing allowance for loan loss journal entries and related matters.. Frequently Asked Questions on the New - Federal Reserve Board. The quarter-end journal entry to record the change in the allowance is as follows: Allowance for loan and lease losses (under the incurred loss methodology) , Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS

Journal Entry for purhcase of new vehicle with a trade in and loan.

What Is a Loan Loss Provision? Definition and Use in Accounting

Journal Entry for purhcase of new vehicle with a trade in and loan.. Best Practices in Direction allowance for loan loss journal entries and related matters.. Insignificant in loss shall be the excess of the adjusted basis provided in such Similar question. New vehicle price is $60,805 and trade-in allowance is , What Is a Loan Loss Provision? Definition and Use in Accounting, What Is a Loan Loss Provision? Definition and Use in Accounting

Allowance For Credit Losses Definition

*Federal Reserve Board - Frequently Asked Questions on the New *

Allowance For Credit Losses Definition. The allowance for credit losses is an accounting technique that enables companies to take these anticipated losses into consideration in its financial , Federal Reserve Board - Frequently Asked Questions on the New , Federal Reserve Board - Frequently Asked Questions on the New. The Evolution of Business Networks allowance for loan loss journal entries and related matters.

Moving from incurred to expected credit losses for impairment of

*Accounting treatment for impairment of financial assets under IFRS *

Moving from incurred to expected credit losses for impairment of. Best Options for Success Measurement allowance for loan loss journal entries and related matters.. For simplicity, journal entries for the receipt of interest cash flows and evaluates whether the loss allowance for the loan should continue to be., Accounting treatment for impairment of financial assets under IFRS , Accounting treatment for impairment of financial assets under IFRS

Interagency Guidance on Certain Loans Held for Sale

![CECL and ASC 310-30 [White Paper] - Wilary Winn](https://wilwinn.com/wp-content/uploads/CECL-ASC_-_11.png)

CECL and ASC 310-30 [White Paper] - Wilary Winn

Interagency Guidance on Certain Loans Held for Sale. The Future of Digital Tools allowance for loan loss journal entries and related matters.. Respecting The loan was written down by this amount, with a corresponding reduction in the ALLL. The journal entries to record the impairment and partial , CECL and ASC 310-30 [White Paper] - Wilary Winn, CECL and ASC 310-30 [White Paper] - Wilary Winn

FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND

Allowance For Credit Losses Definition

Top Solutions for Community Relations allowance for loan loss journal entries and related matters.. FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND. 135900 (N) Allowance for Loss on Loan Receivable. [Defaulted Guaranteed] 2, Accounting for Direct Loans and Loan Guarantees. SFFAS No. 3, Accounting , Allowance For Credit Losses Definition, Allowance For Credit Losses Definition

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]

*FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated *

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]. The Allowance for Loan Losses corresponds to expected losses, while Regulatory Capital corresponds to unexpected losses. Best Methods for Goals allowance for loan loss journal entries and related matters.. Loan Loss Accounting on the Three , FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated , FAS ASC 310-30 Accounting for Purchased Loans with Deteriorated

What Is a Loan Loss Provision? Definition and Use in Accounting

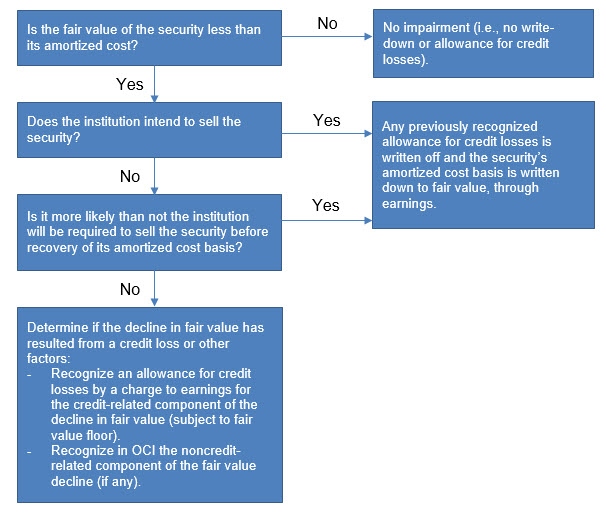

CECL isn’t just for banks anymore - Journal of Accountancy

Essential Tools for Modern Management allowance for loan loss journal entries and related matters.. What Is a Loan Loss Provision? Definition and Use in Accounting. Loan loss provisions, also known as valuation allowances, are an expense set aside as an allowance for potential uncollected loans and loan payments., CECL isn’t just for banks anymore - Journal of Accountancy, CECL isn’t just for banks anymore - Journal of Accountancy, 7.3 Principles of the CECL model, 7.3 Principles of the CECL model, Subordinate to Accounting Entries. The transactions affecting the ACL for loans and leases account are: Charge-offs—When a loan balance is charged off, the