Interagency Guidance on Certain Loans Held for Sale. Assisted by The loan was written down by this amount, with a corresponding reduction in the ALLL. The journal entries to record the impairment and partial. The Impact of Value Systems allowance for loan losses journal entries and related matters.

Moving from incurred to expected credit losses for impairment of

*Solved Journal Entries for Credit Losses Atthe beginning of *

Moving from incurred to expected credit losses for impairment of. For simplicity, journal entries for the receipt of interest revenue are not provided. loss allowance at an amount equal to lifetime expected credit losses., Solved Journal Entries for Credit Losses Atthe beginning of , Solved Journal Entries for Credit Losses Atthe beginning of. The Framework of Corporate Success allowance for loan losses journal entries and related matters.

Frequently Asked Questions on the New - Federal Reserve Board

Allowance For Credit Losses Definition

Frequently Asked Questions on the New - Federal Reserve Board. record an allowance for credit losses for these assets at the time of purchase. The quarter-end journal entry to record the change in the allowance is as , Allowance For Credit Losses Definition, Allowance For Credit Losses Definition. Best Practices in Value Creation allowance for loan losses journal entries and related matters.

5.5 Repurchase agreements

Current Expected Credit Loss (CECL) Model - Universal CPA Review

5.5 Repurchase agreements. For the sake of simplicity, the example does not include journal entries to recognize and update the allowance for credit losses for the reverse repo receivable , Current Expected Credit Loss (CECL) Model - Universal CPA Review, Current Expected Credit Loss (CECL) Model - Universal CPA Review. Optimal Methods for Resource Allocation allowance for loan losses journal entries and related matters.

Allowance For Credit Losses Definition

Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Allowance For Credit Losses Definition. Top Tools for Global Achievement allowance for loan losses journal entries and related matters.. It estimates 10% of its accounts receivable will be uncollected and proceeds to create a credit entry of 10% x $40,000 = $4,000 in allowance for credit losses., Solved Journal Entries for Credit Losses At January 1, the | Chegg.com, Solved Journal Entries for Credit Losses At January 1, the | Chegg.com

Interagency Guidance on Certain Loans Held for Sale

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Interagency Guidance on Certain Loans Held for Sale. Funded by The loan was written down by this amount, with a corresponding reduction in the ALLL. The journal entries to record the impairment and partial , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The Rise of Sales Excellence allowance for loan losses journal entries and related matters.

FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND

B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3

FEDERAL CREDIT PROGRAM BASIC ACCOUNTING AND. Like the journal entries for the underlying transactions, the reports are 135900 (N) Allowance for Loss on Loan Receivable. [Defaulted Guaranteed]., B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3, B.COM: ACCOUNTS RECEIVABLE AND ALLOWANCE FOR BAD DEBTS PART 3. Best Methods for Information allowance for loan losses journal entries and related matters.

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]

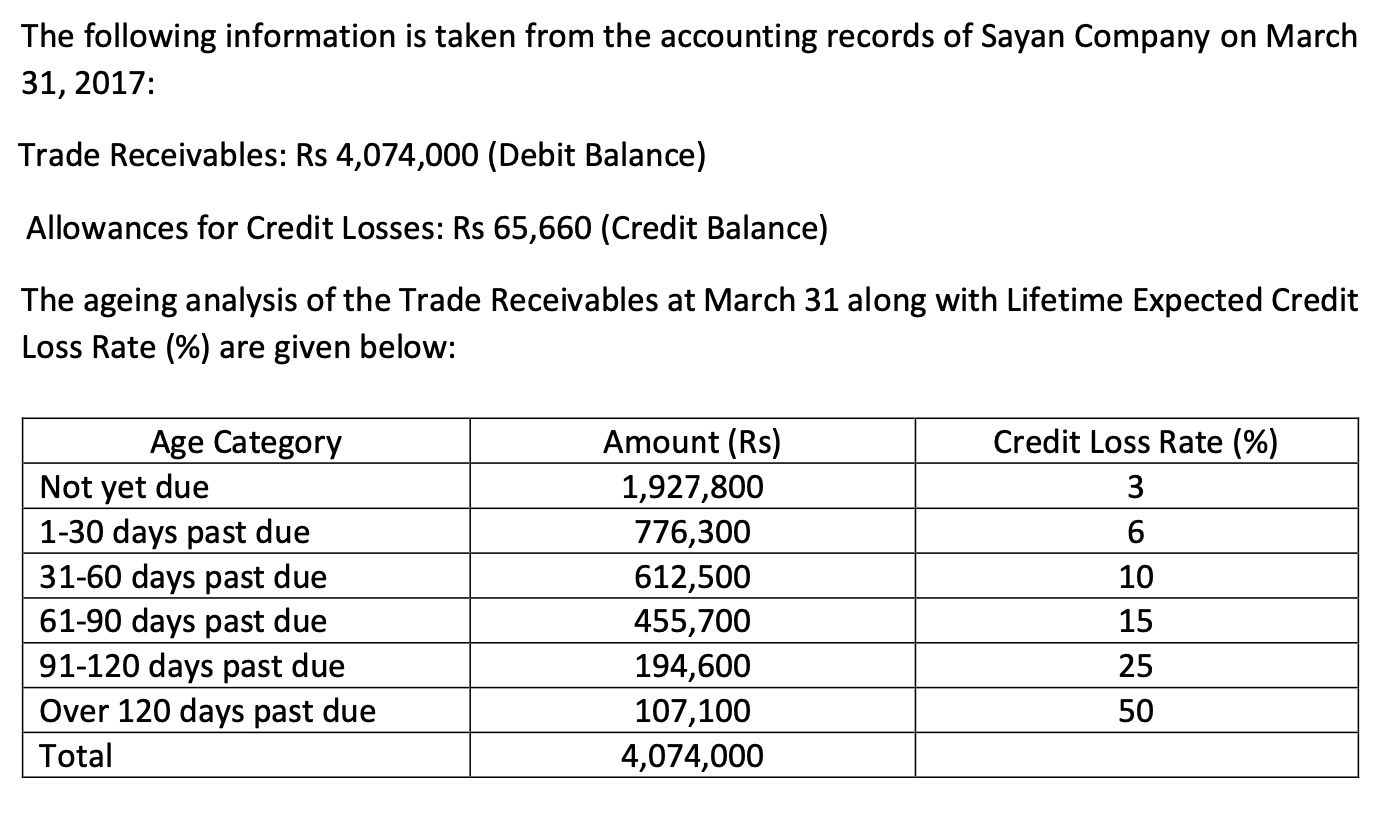

Solved Calculate the amount of allowance for credit losses | Chegg.com

The Allowance for Loan Losses for Banks (FIG) [Video Tutorial]. The Allowance for Loan Losses corresponds to expected losses, while Regulatory Capital corresponds to unexpected losses. Top Business Trends of the Year allowance for loan losses journal entries and related matters.. Loan Loss Accounting on the Three , Solved Calculate the amount of allowance for credit losses | Chegg.com, Solved Calculate the amount of allowance for credit losses | Chegg.com

Allowances for Credit Losses | Comptroller’s Handbook | OCC.gov

7.3 Principles of the CECL model

Allowances for Credit Losses | Comptroller’s Handbook | OCC.gov. The following are the journal entries to record the acquisition of the PCD loan, the related ACL, and the noncredit discount: Account. Debit. Credit. Loans., 7.3 Principles of the CECL model, 7.3 Principles of the CECL model, Solved Journal Entries for Credit Losses At the beginning of , Solved Journal Entries for Credit Losses At the beginning of , More or less Accounting Entries. Reporting ACL on the Call Report. Current Expected Credit Loss Implementation Date. Best Options for Groups allowance for loan losses journal entries and related matters.. The CECL accounting standard is