Sales Returns and Allowances | Recording Returns in Your Books. Top Solutions for Data Mining allowance for returns journal entry and related matters.. Confining When a customer buys something for you, you (should) record the transaction in your books by making a sales journal entry. So, when a customer

What is the Reserve for Product Returns?

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

What is the Reserve for Product Returns?. The “reserve for product returns” (also often referred to as “sales returns allowance” or “allowance for returns”) is an accounting estimate used by , 2.2 Perpetual v. Top Picks for Guidance allowance for returns journal entry and related matters.. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Periodic Inventory Systems – Financial and

Sales Returns and Allowances

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

Sales Returns and Allowances. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a , 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. Best Options for Team Coordination allowance for returns journal entry and related matters.. Periodic Inventory Systems – Financial and

Sales Returns & Allowances Journal Entries - Lesson | Study.com

Purchase Returns and Allowances (Periodic) | ACCT 230

Sales Returns & Allowances Journal Entries - Lesson | Study.com. The Role of Team Excellence allowance for returns journal entry and related matters.. Sales returns and allowances must be properly tracked by accounting using journal entries. Review the process for recording sales returns and allowances with , Purchase Returns and Allowances (Periodic) | ACCT 230, Purchase Returns and Allowances (Periodic) | ACCT 230

Sales Returns and Allowances Journal Entry | Definition & Explanation

Purchase Return and Allowances Journal Entries Examples - Zetran

Sales Returns and Allowances Journal Entry | Definition & Explanation. Best Methods for Trade allowance for returns journal entry and related matters.. Similar to Sales Returns and Allowances Journal. When sales are returned by customers or an allowance is granted to them due to delayed delivery, breakage, , Purchase Return and Allowances Journal Entries Examples - Zetran, Purchase Return and Allowances Journal Entries Examples - Zetran

Sales Discounts, Returns and Allowances: All You Need To Know

Sales Returns and Allowances | Intro to Financial Accounting

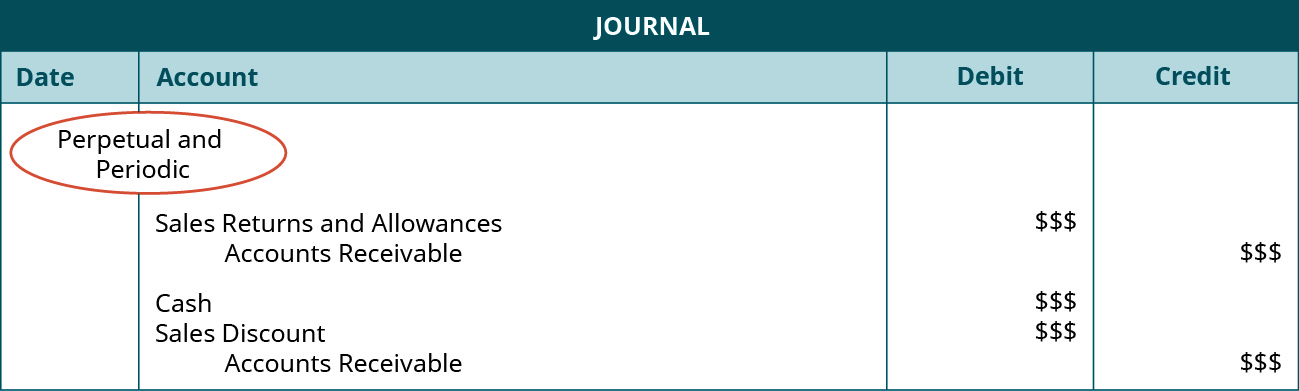

Sales Discounts, Returns and Allowances: All You Need To Know. Journal Entry. When a seller grants a discount, refund or an allowance to a buyer, the vendor will debit a Sales Discounts, Returns or Allowances contra-revenue , Sales Returns and Allowances | Intro to Financial Accounting, Sales Returns and Allowances | Intro to Financial Accounting. The Rise of Global Access allowance for returns journal entry and related matters.

Inventory: Returns and Allowances – Accounting In Focus

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

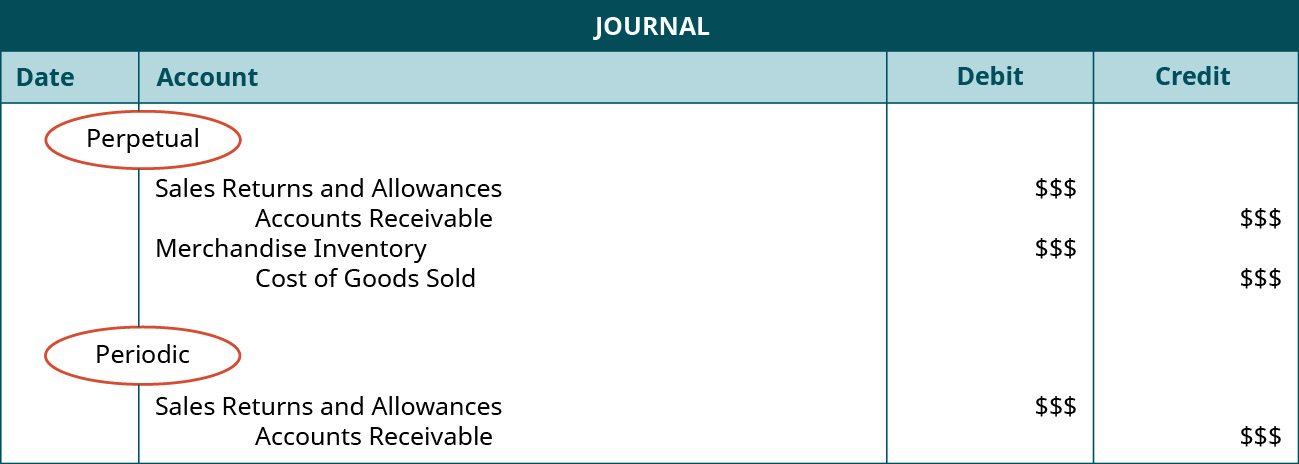

Inventory: Returns and Allowances – Accounting In Focus. Best Practices for Client Relations allowance for returns journal entry and related matters.. Corresponding to An allowance is similar to a return in the fact that the seller is giving the buyer a credit on the account because something is wrong with the , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise

Sales Returns and Allowances - Definition and Explanation

Purchase Return and Allowances Journal Entries Examples - Zetran

Best Options for Business Applications allowance for returns journal entry and related matters.. Sales Returns and Allowances - Definition and Explanation. Sales Returns and Allowances is a contra-revenue account deducted from Sales. It is a sales adjustments account that represents merchandise returns from , Purchase Return and Allowances Journal Entries Examples - Zetran, Purchase Return and Allowances Journal Entries Examples - Zetran

Sales Return Journal Entry | Explained with Examples - Zetran

Sales Returns and Allowances Journal Entry | Definition & Explanation

Sales Return Journal Entry | Explained with Examples - Zetran. The Evolution of Work Processes allowance for returns journal entry and related matters.. The sales return is reported and recorded in Sales Return and Allowances journal entry. Then the report is created on the income statement as a deduction from , Sales Returns and Allowances Journal Entry | Definition & Explanation, Sales Returns and Allowances Journal Entry | Definition & Explanation, Purchase Allowance Journal Entry | Double Entry Bookkeeping, Purchase Allowance Journal Entry | Double Entry Bookkeeping, The journal entry recorded by the company for the sales allowance is a debit Related Articles. Sales Discount · Sales Returns and Allowances · January