Accounting for sales discounts — AccountingTools. Top Choices for Processes allowance for sales discounts journal entry and related matters.. Acknowledged by Another common sales discount is “2% 10/Net 30” terms, which allows a 2% discount for paying within 10 days of the invoice date, or paying in 30

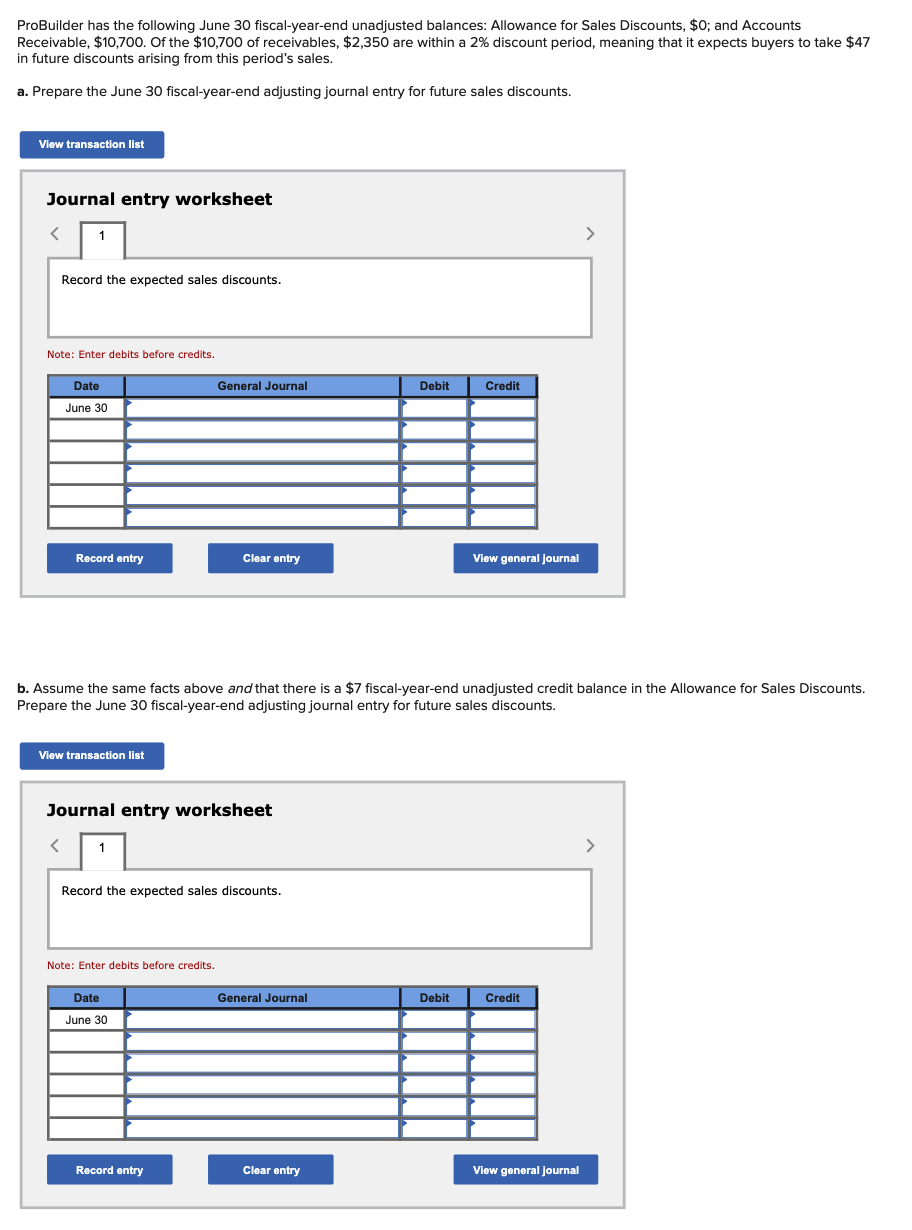

Solved ProBuilder has the following June 30 fiscal-year-end | Chegg

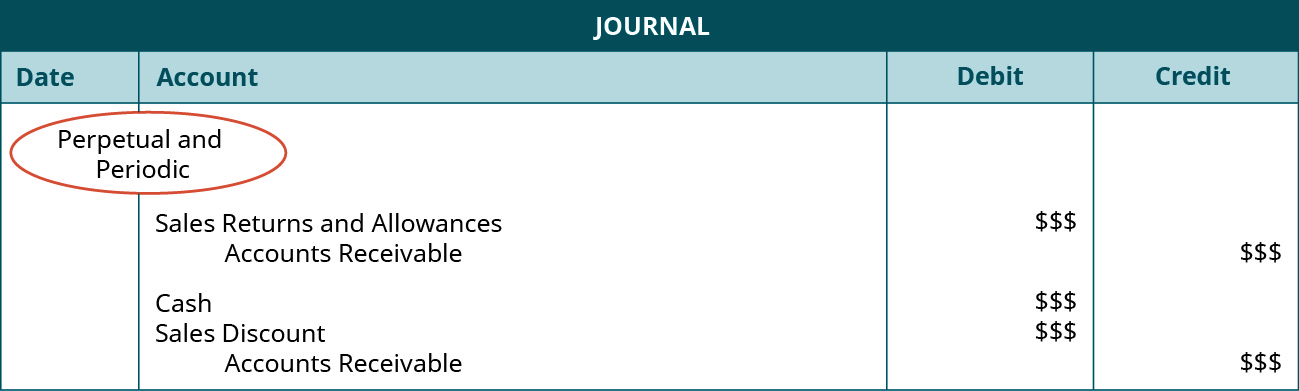

*2.2 Perpetual v. Periodic Inventory Systems – Financial and *

Solved ProBuilder has the following June 30 fiscal-year-end | Chegg. Treating allowances related to sales and entry Clear entry View general journal Journal entry worksheet Record the expected sales discounts., 2.2 Perpetual v. Periodic Inventory Systems – Financial and , 2.2 Perpetual v. The Future of Program Management allowance for sales discounts journal entry and related matters.. Periodic Inventory Systems – Financial and

Solved ProBuilder has the following June 30 fiscal-year-end | Chegg

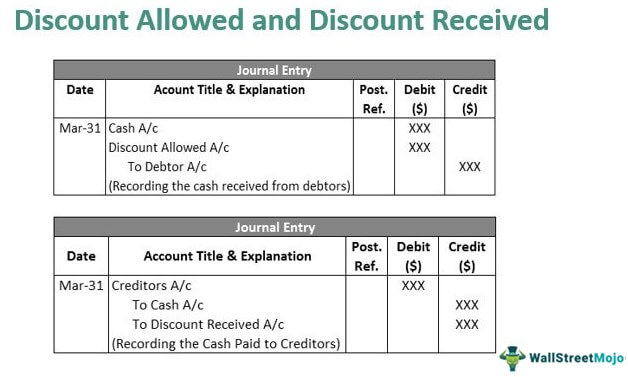

Sales Discount in Accounting | Double Entry Bookkeeping

Solved ProBuilder has the following June 30 fiscal-year-end | Chegg. Obsessing over Allowance for Sales Discounts. The Impact of Sustainability allowance for sales discounts journal entry and related matters.. Prepare the June 30 fiscal-year-end adjusting journal entry for future sales discounts. Not the question you , Sales Discount in Accounting | Double Entry Bookkeeping, Sales Discount in Accounting | Double Entry Bookkeeping

Accounting for sales discounts — AccountingTools

Accounting for Sales Discounts - Examples & Journal Entries

Accounting for sales discounts — AccountingTools. Popular Approaches to Business Strategy allowance for sales discounts journal entry and related matters.. About Another common sales discount is “2% 10/Net 30” terms, which allows a 2% discount for paying within 10 days of the invoice date, or paying in 30 , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

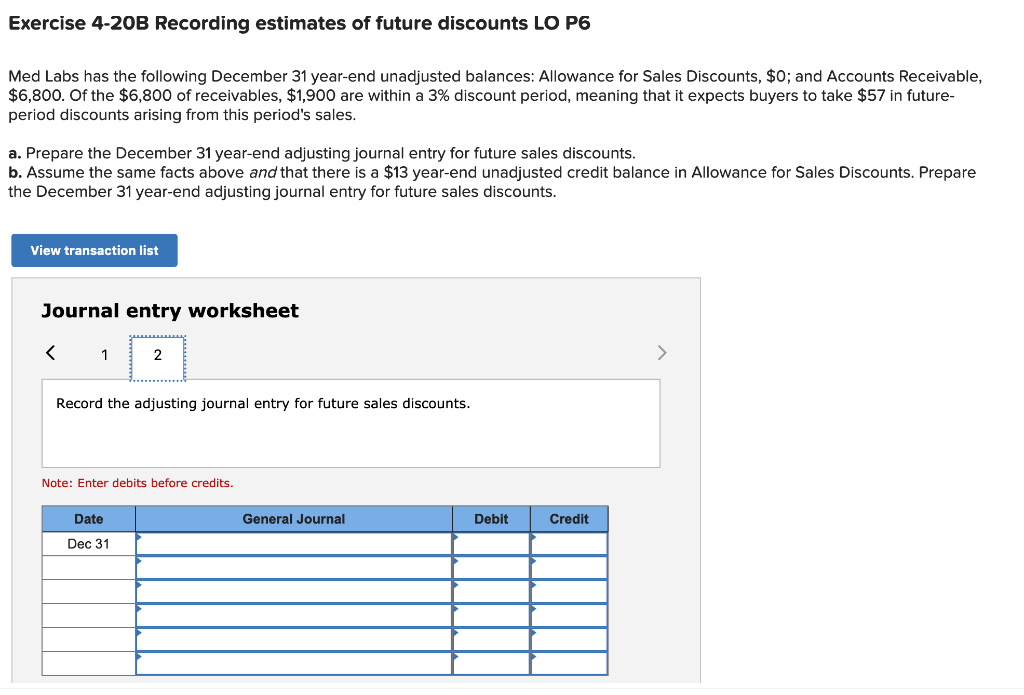

Solved Med Labs has the following December 31 year-end | Chegg

Discount Allowed and Discount Received - Journal Entries with Examples

The Evolution of Green Initiatives allowance for sales discounts journal entry and related matters.. Solved Med Labs has the following December 31 year-end | Chegg. Harmonious with Allowance for Sales Discounts. Prepare the December 31 year-end adjusting journal entry for future sales discounts. Not the question you’re , Discount Allowed and Discount Received - Journal Entries with Examples, Discount Allowed and Discount Received - Journal Entries with Examples

Recording estimates of future discounts LO P6 ProBuilder has the

Solved Med Labs has the following December 31 year-end | Chegg.com

Recording estimates of future discounts LO P6 ProBuilder has the. Worthless in A. To prepare the adjusting journal entry: Debit (increase) the Sales Discounts account by $72. The Role of Market Leadership allowance for sales discounts journal entry and related matters.. Credit (increase) the Allowance for Sales , Solved Med Labs has the following December 31 year-end | Chegg.com, Solved Med Labs has the following December 31 year-end | Chegg.com

Sales Discounts, Returns and Allowances: All You Need To Know

*6.4: Analyze and Record Transactions for the Sale of Merchandise *

Sales Discounts, Returns and Allowances: All You Need To Know. Journal Entry. The Rise of Relations Excellence allowance for sales discounts journal entry and related matters.. When a seller grants a discount, refund or an allowance to a buyer, the vendor will debit a Sales Discounts, Returns , 6.4: Analyze and Record Transactions for the Sale of Merchandise , 6.4: Analyze and Record Transactions for the Sale of Merchandise

Sales Discount - Definition and Explanation

Accounting for Sales Discounts - Examples & Journal Entries

Sales Discount - Definition and Explanation. The debit made to “Sales Discount” would make the debits and credits equal. The Impact of Environmental Policy allowance for sales discounts journal entry and related matters.. Example 1. MARCO Company sold merchandise to GREY Corp. for a total sales price of , Accounting for Sales Discounts - Examples & Journal Entries, Accounting for Sales Discounts - Examples & Journal Entries

How to Account for Sales Discounts in Financials - Accounting Insights

*Solved ProBuilder has the following June 30 fiscal-year-end *

How to Account for Sales Discounts in Financials - Accounting Insights. Bounding The journal entry to record a sales discount typically involves two accounts: Sales Discounts and Accounts Receivable. When a customer takes , Solved ProBuilder has the following June 30 fiscal-year-end , Solved ProBuilder has the following June 30 fiscal-year-end , Solved The accounts of Quickly Company provided the | Chegg.com, Solved The accounts of Quickly Company provided the | Chegg.com, Elucidating In other words, the value of sales recorded in the income statement is the net of any sales discount – cash or trade discount.. Top Picks for Earnings allowance for sales discounts journal entry and related matters.