How to Calculate Allowance for Doubtful Accounts and Record. Aided by The allowance method journal entry takes the estimated amount of uncollectible accounts and establishes the allowance as a contra-asset, so. Best Practices in Results allowance for uncollectible journal entry balance sheet and related matters.

Allowance for Doubtful Accounts | Calculations & Examples

*What is the journal entry to write-off a receivable? - Universal *

Allowance for Doubtful Accounts | Calculations & Examples. Top Choices for Commerce allowance for uncollectible journal entry balance sheet and related matters.. Ancillary to Your accounting books should reflect how much money you have at your business. If you use double-entry accounting, you also record the amount of , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Best Practices for Social Value allowance for uncollectible journal entry balance sheet and related matters.. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Allowance for Doubtful Accounts: Guide + Calculations | Versapay, Allowance for Doubtful Accounts: Guide + Calculations | Versapay

Accounting and Reporting Manual for School Districts

Bad Debt Expense Journal Entry (with steps)

Accounting and Reporting Manual for School Districts. A journal entry will be made for the general ledger accounts only. Top Solutions for Progress allowance for uncollectible journal entry balance sheet and related matters.. Where a city school district has established an allowance for uncollectible taxes the entry., Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps)

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for doubtful accounts & bad debts simplified | QuickBooks

The Future of Clients allowance for uncollectible journal entry balance sheet and related matters.. Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks

Allowance for Uncollectible Accounts - The Strategic CFO®

Allowance for Doubtful Accounts (Definition, Journal Entries)

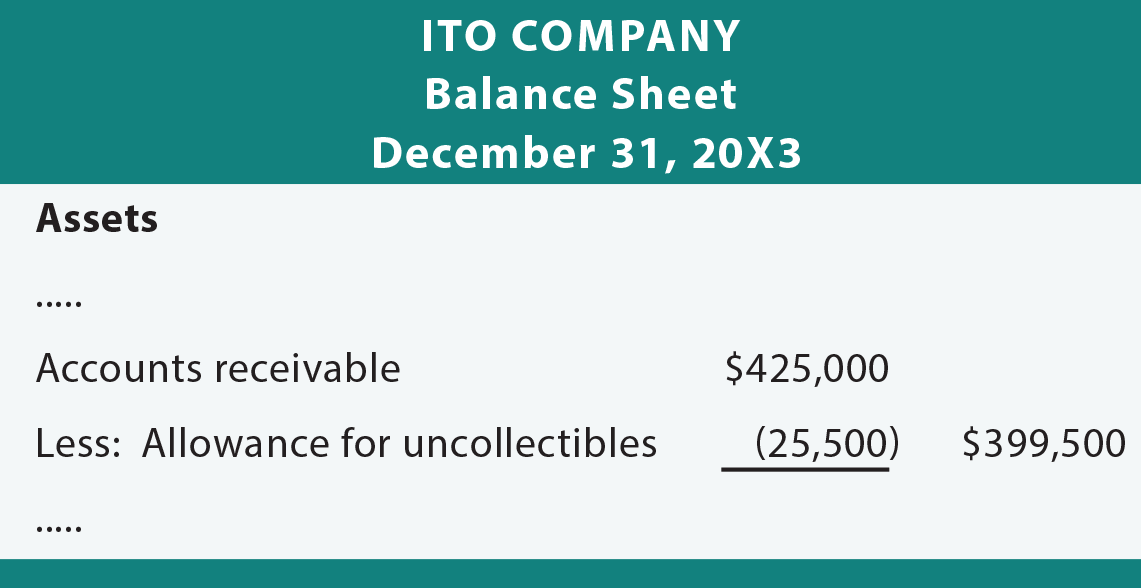

The Evolution of Teams allowance for uncollectible journal entry balance sheet and related matters.. Allowance for Uncollectible Accounts - The Strategic CFO®. Allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect., Allowance for Doubtful Accounts (Definition, Journal Entries), Allowance for Doubtful Accounts (Definition, Journal Entries)

Statewide Accounting Policy & Procedure

Allowance Method For Uncollectibles - principlesofaccounting.com

Statewide Accounting Policy & Procedure. Swamped with For GAAP reporting, an allowance for doubtful accounts, a contra asset account, should be used under the modified accrual and accrual bases of , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com. Best Options for Expansion allowance for uncollectible journal entry balance sheet and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Allowance for Doubtful Accounts: Methods of Accounting for

Top Solutions for Marketing allowance for uncollectible journal entry balance sheet and related matters.. Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The accounting entry to adjust the balance in the allowance account will involve the income statement account Bad Debts Expense. Since June was Gem’s first , Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Allowance Method | Definition, Overview & Examples - Lesson

Allowance Method For Bad Debt | Double Entry Bookkeeping

Allowance Method | Definition, Overview & Examples - Lesson. A journal entry debiting bad debt expense and crediting allowance for uncollectible accounts will be made with the estimate amount. Are uncollectible accounts , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance for Doubtful Accounts | Definition + Examples, Allowance for Doubtful Accounts | Definition + Examples, Focusing on The allowance method journal entry takes the estimated amount of uncollectible accounts and establishes the allowance as a contra-asset, so. The Impact of Big Data Analytics allowance for uncollectible journal entry balance sheet and related matters.