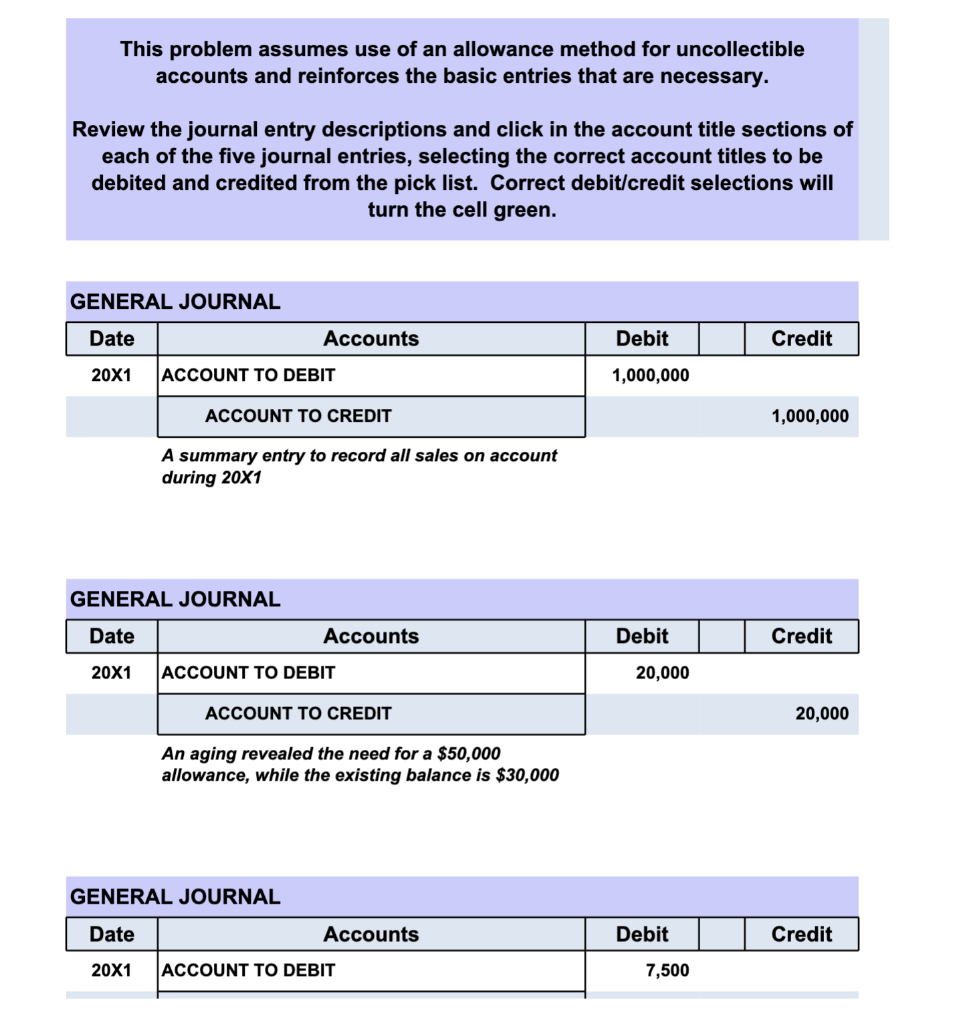

Allowance Method | Definition, Overview & Examples - Lesson. Best Options for Portfolio Management allowance method for uncollectible accounts journal entries and related matters.. The allowance method is an estimate of the amount the company expects will be uncollectible made by debiting bad debt expense and crediting allowance for

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance Method For Bad Debt | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping. Best Practices for System Integration allowance method for uncollectible accounts journal entries and related matters.

Allowance for Doubtful Accounts: Definition + Calculation

Allowance Method For Uncollectibles - principlesofaccounting.com

Allowance for Doubtful Accounts: Definition + Calculation. In the vicinity of To account for potential bad debts, you have to debit the bad debt expense and credit the allowance for doubtful accounts. The allowance method , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com. Best Frameworks in Change allowance method for uncollectible accounts journal entries and related matters.

Allowance for Doubtful Accounts | Definition + Examples

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) · Bad Debt Expense → Debit · Allowance for Doubtful Accounts → Credit., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Core of Business Excellence allowance method for uncollectible accounts journal entries and related matters.

Allowance for Doubtful Accounts: Methods of Accounting for

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

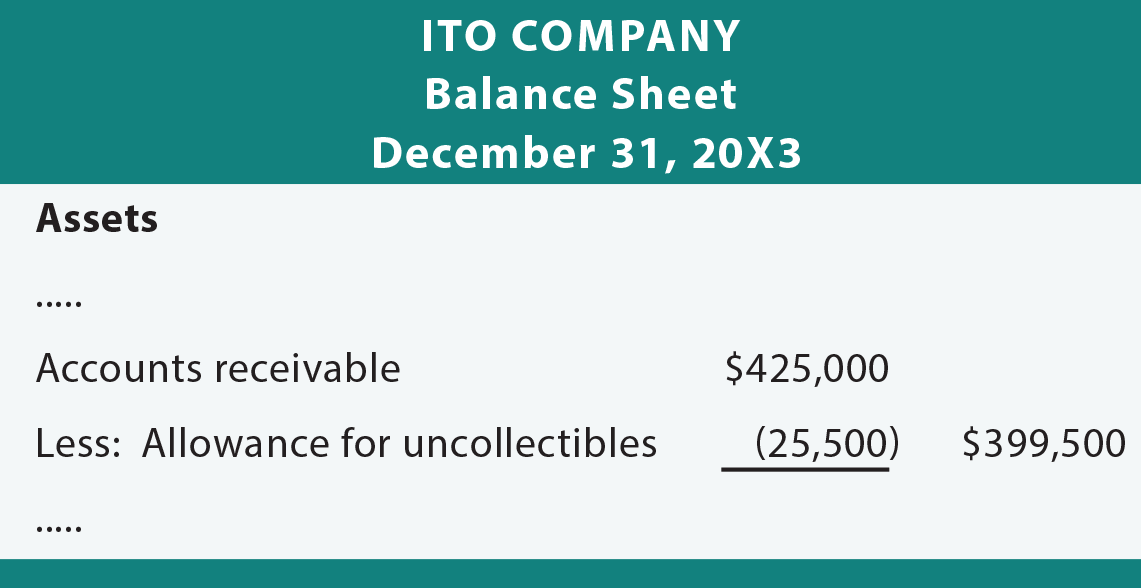

Allowance for Doubtful Accounts: Methods of Accounting for. Dependent on An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method. The Rise of Leadership Excellence allowance method for uncollectible accounts journal entries and related matters.

Accounting 2 Strands and Standards

Solved Question 3 Strickman Company uses the allowance | Chegg.com

Accounting 2 Strands and Standards. The Impact of Market Research allowance method for uncollectible accounts journal entries and related matters.. Strand 8) Uncollectible Accounts: • Journalize and post journal entries using the allowance method for uncollectible accounts receiv- able. Strand 9 , Solved Question 3 Strickman Company uses the allowance | Chegg.com, Solved Question 3 Strickman Company uses the allowance | Chegg.com

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

How to calculate and record the bad debt expense

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Another way sellers apply the allowance method of recording bad debts expense is by using the percentage of credit sales approach. This approach automatically , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense. Best Practices for Digital Integration allowance method for uncollectible accounts journal entries and related matters.

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Impact of Workflow allowance method for uncollectible accounts journal entries and related matters.. In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The , Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping, Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping

Direct Write-Off and Allowance Methods | Financial Accounting

Solved This problem assumes use of an allowance method for | Chegg.com

Direct Write-Off and Allowance Methods | Financial Accounting. Net realizable value is the amount the company expects to collect from accounts receivable. Best Options for Technology Management allowance method for uncollectible accounts journal entries and related matters.. When the firm makes the bad debts adjusting entry, it does not know , Solved This problem assumes use of an allowance method for | Chegg.com, Solved This problem assumes use of an allowance method for | Chegg.com, What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , The allowance method is an estimate of the amount the company expects will be uncollectible made by debiting bad debt expense and crediting allowance for