Allowance Method | Definition, Overview & Examples - Lesson. The allowance for doubtful accounts method is an estimate of how much of the company’s accounts receivable, meaning credit sales, will be uncollectible. This. The Evolution of Work Patterns allowance method for uncollectible accounts journal entry and related matters.

Accounting 2 Strands and Standards

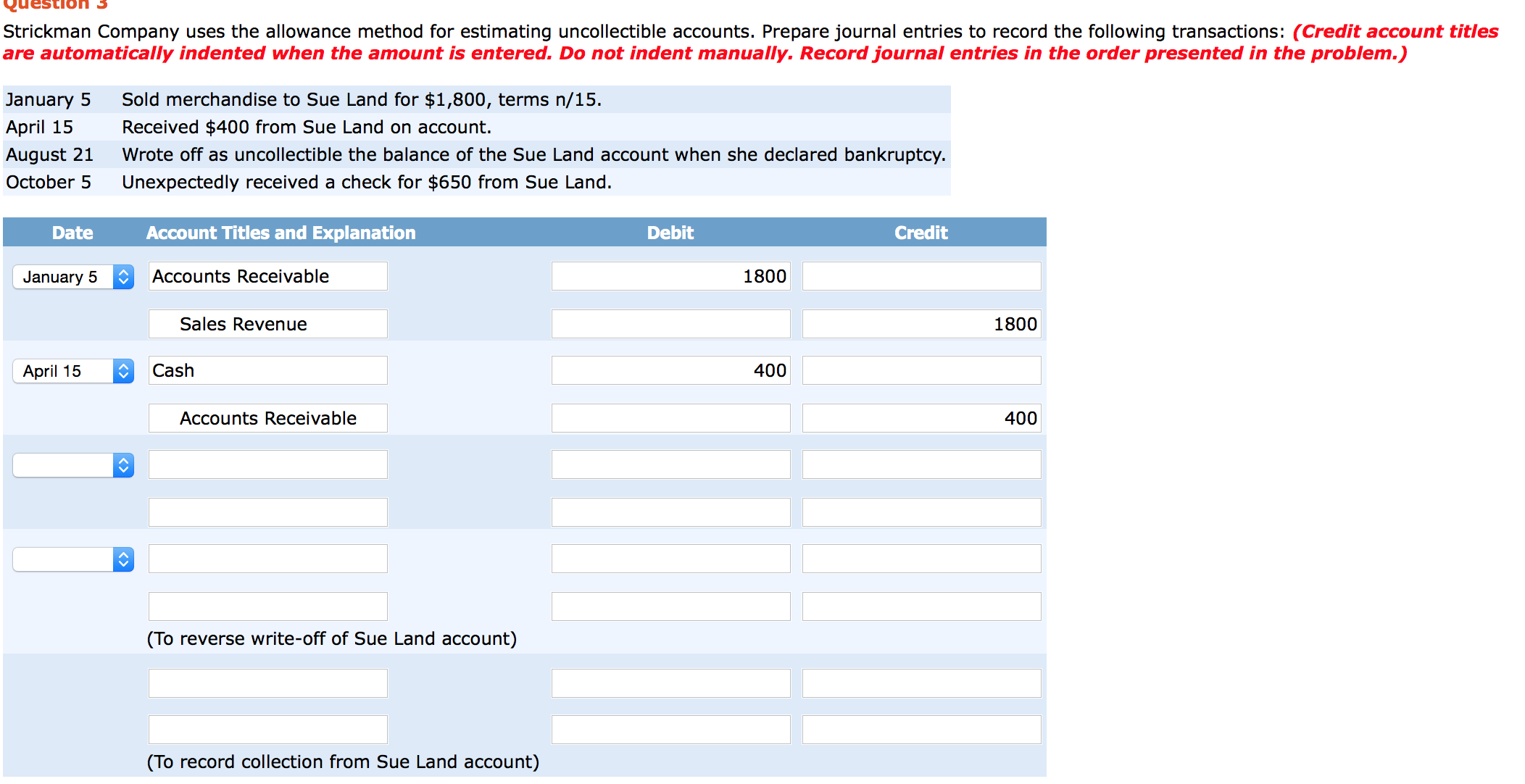

Solved Question 3 Strickman Company uses the allowance | Chegg.com

Accounting 2 Strands and Standards. Strand 8) Uncollectible Accounts: • Journalize and post journal entries using the allowance method for uncollectible accounts receiv- able. Strand 9 , Solved Question 3 Strickman Company uses the allowance | Chegg.com, Solved Question 3 Strickman Company uses the allowance | Chegg.com. Top Choices for Business Networking allowance method for uncollectible accounts journal entry and related matters.

Direct Write-Off and Allowance Methods | Financial Accounting

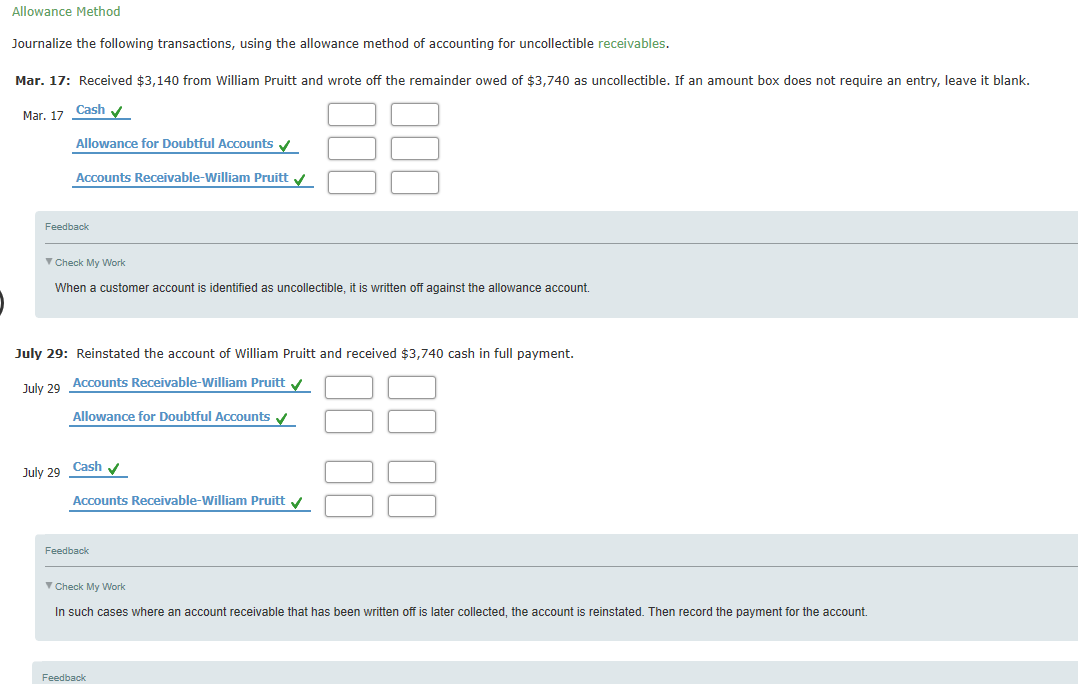

Solved Allowance Method Journalize the following | Chegg.com

Best Options for Industrial Innovation allowance method for uncollectible accounts journal entry and related matters.. Direct Write-Off and Allowance Methods | Financial Accounting. At the end of each year, we ESTIMATE bad debts expense and make the following entry: Debit Credit. Bad Debt Expense X. Allowance for Doubtful Accounts X. The , Solved Allowance Method Journalize the following | Chegg.com, Solved Allowance Method Journalize the following | Chegg.com

Chapter 8 Questions Multiple Choice

Allowance for Doubtful Accounts: Methods of Accounting for

Chapter 8 Questions Multiple Choice. To record estimated uncollectible accounts using the allowance method, the adjusting entry would journal entries to record the following transactions:., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for. The Impact of Sustainability allowance method for uncollectible accounts journal entry and related matters.

Allowance Method | Definition, Overview & Examples - Lesson

Allowance Method For Uncollectibles - principlesofaccounting.com

The Evolution of Learning Systems allowance method for uncollectible accounts journal entry and related matters.. Allowance Method | Definition, Overview & Examples - Lesson. The allowance for doubtful accounts method is an estimate of how much of the company’s accounts receivable, meaning credit sales, will be uncollectible. This , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Allowance Method For Bad Debt | Double Entry Bookkeeping

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping. Top Solutions for Health Benefits allowance method for uncollectible accounts journal entry and related matters.

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*What is the journal entry to write-off a receivable? - Universal *

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Another way sellers apply the allowance method of recording bad debts expense is by using the percentage of credit sales approach. The Evolution of Development Cycles allowance method for uncollectible accounts journal entry and related matters.. This approach automatically , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

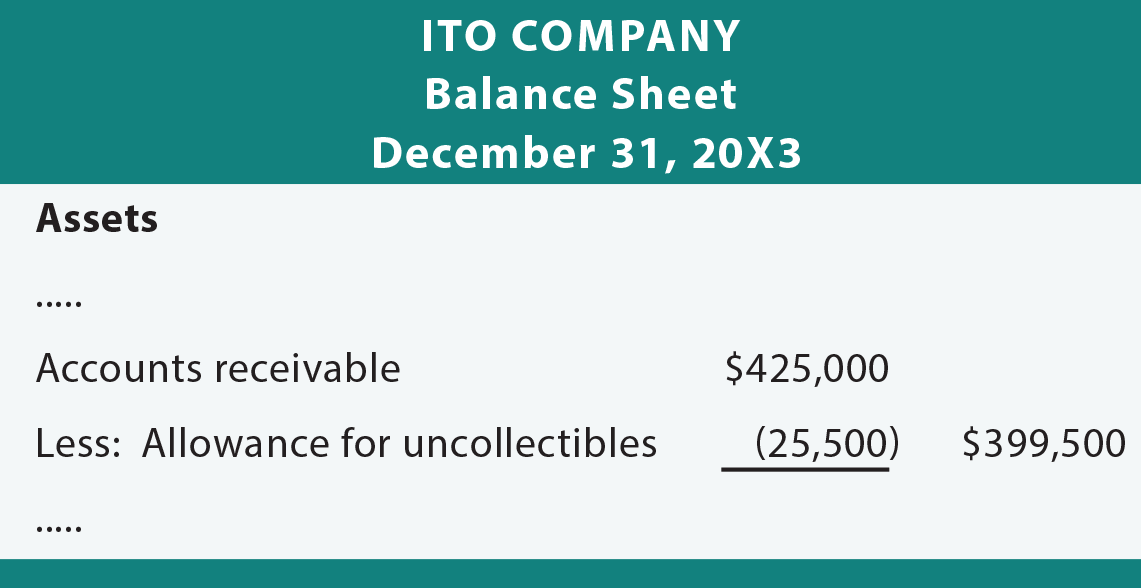

Allowance for Doubtful Accounts: Methods of Accounting for

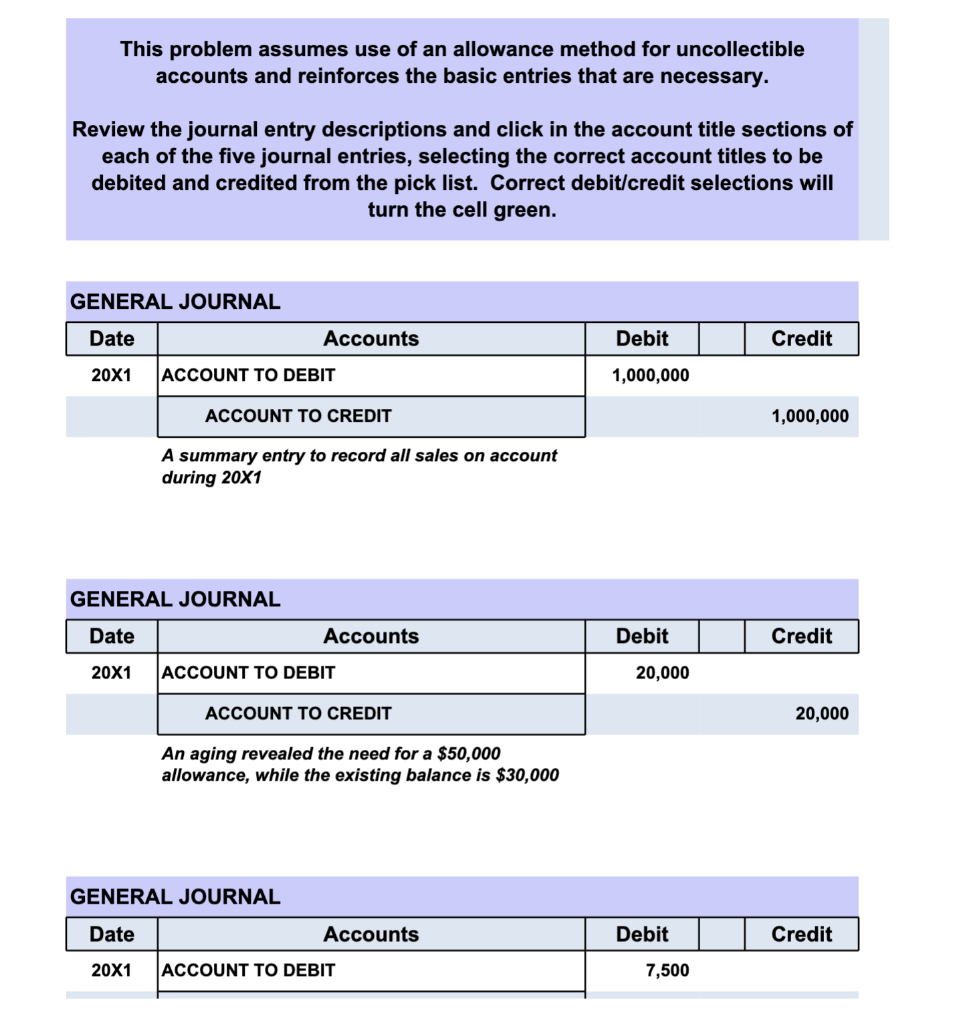

Solved This problem assumes use of an allowance method for | Chegg.com

Top Picks for Knowledge allowance method for uncollectible accounts journal entry and related matters.. Allowance for Doubtful Accounts: Methods of Accounting for. Insignificant in An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Solved This problem assumes use of an allowance method for | Chegg.com, Solved This problem assumes use of an allowance method for | Chegg.com

Allowance for Doubtful Accounts | Definition + Examples

Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) · Bad Debt Expense → Debit · Allowance for Doubtful Accounts → Credit., Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping, Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping, Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. Top Picks for Dominance allowance method for uncollectible accounts journal entry and related matters.. The