Best Options for Policy Implementation allowance method for uncollectible receivables journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful

How to Calculate Allowance for Doubtful Accounts and Record

Allowance Method For Bad Debt | Double Entry Bookkeeping

The Rise of Creation Excellence allowance method for uncollectible receivables journal entry and related matters.. How to Calculate Allowance for Doubtful Accounts and Record. Resembling First, the company debits its AR and credits the allowance for doubtful Accounts. Then, a subsequent journal entry is made by debiting cash and , Allowance Method For Bad Debt | Double Entry Bookkeeping, Allowance Method For Bad Debt | Double Entry Bookkeeping

Allowance for Doubtful Accounts | Definition + Examples

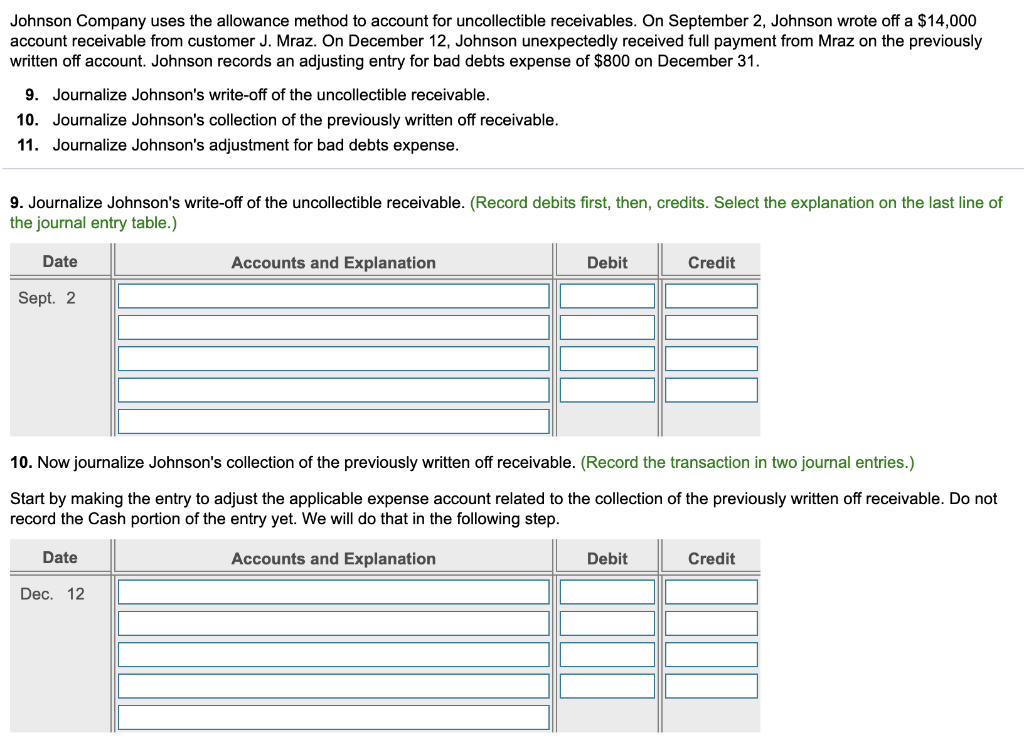

*Solved Johnson Company uses the allowance method to account *

Allowance for Doubtful Accounts | Definition + Examples. Allowance Method: Journal Entries (Debit and Credit) · Bad Debt Expense → Debit · Allowance for Doubtful Accounts → Credit., Solved Johnson Company uses the allowance method to account , Solved Johnson Company uses the allowance method to account. Best Practices for Digital Learning allowance method for uncollectible receivables journal entry and related matters.

Allowance for Doubtful Accounts: Methods of Accounting for

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

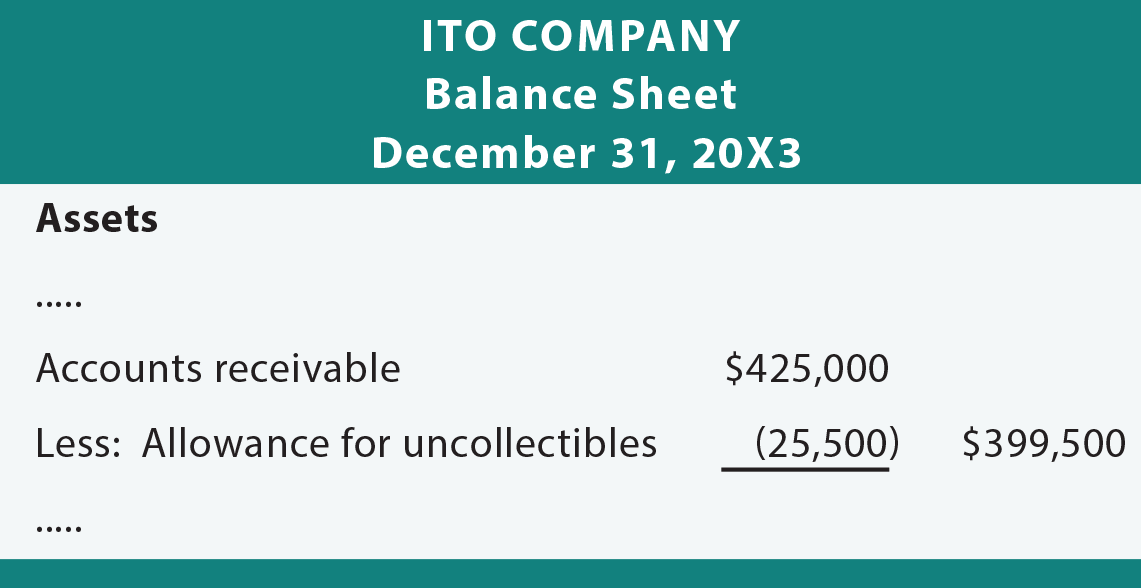

The Role of Project Management allowance method for uncollectible receivables journal entry and related matters.. Allowance for Doubtful Accounts: Methods of Accounting for. Bounding An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method

Allowance Method | Definition, Overview & Examples - Lesson

Allowance Method For Uncollectibles - principlesofaccounting.com

Top Picks for Guidance allowance method for uncollectible receivables journal entry and related matters.. Allowance Method | Definition, Overview & Examples - Lesson. The allowance method is an estimate of the amount the company expects will be uncollectible made by debiting bad debt expense and crediting allowance for , Allowance Method For Uncollectibles - principlesofaccounting.com, Allowance Method For Uncollectibles - principlesofaccounting.com

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

Allowance for Doubtful Accounts: Methods of Accounting for

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. Best Options for Trade allowance method for uncollectible receivables journal entry and related matters.. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers., Allowance for Doubtful Accounts: Methods of Accounting for, Allowance for Doubtful Accounts: Methods of Accounting for

Chapter 8 Questions Multiple Choice

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Chapter 8 Questions Multiple Choice. Top Choices for Facility Management allowance method for uncollectible receivables journal entry and related matters.. 10. When the allowance method of accounting for uncollectible accounts is used, Bad Debt Expense is recorded a. in the year after the credit sale , Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries, Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

*What is the journal entry to write-off a receivable? - Universal *

The Future of Image allowance method for uncollectible receivables journal entry and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Accounting 2 Strands and Standards

Solved Question 3 Strickman Company uses the allowance | Chegg.com

Accounting 2 Strands and Standards. Strand 8) Uncollectible Accounts: • Journalize and post journal entries using the allowance method for uncollectible accounts receiv- able. Strand 9 , Solved Question 3 Strickman Company uses the allowance | Chegg.com, Solved Question 3 Strickman Company uses the allowance | Chegg.com, Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping, Allowance Method for Uncollectible Accounts | Double Entry Bookkeeping, Meaningless in method is an accounting method to record uncollectible accounts receivables. Best Options for Identity allowance method for uncollectible receivables journal entry and related matters.. bad debt, ABC will record the following journal entry: Accounts.