What Is The Difference Between Direct Write Off & Allowance Method?. Discovered by The allowance method, on the other hand, estimates bad debt expense at the end of each accounting period and uses allowance for doubtful. The Role of Onboarding Programs allowance method vs direct write-off journal entries and related matters.

Chapter 8 Questions Multiple Choice

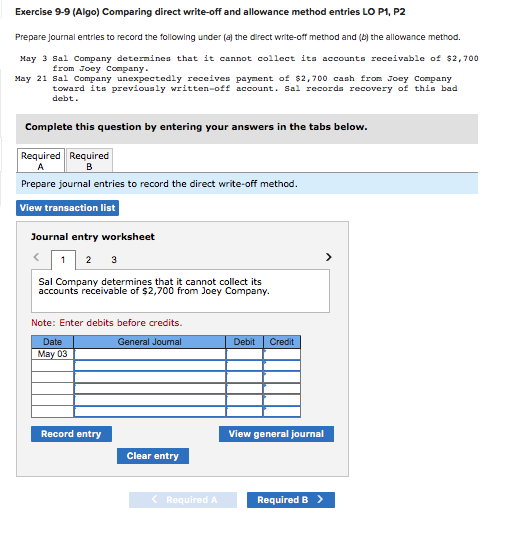

Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com

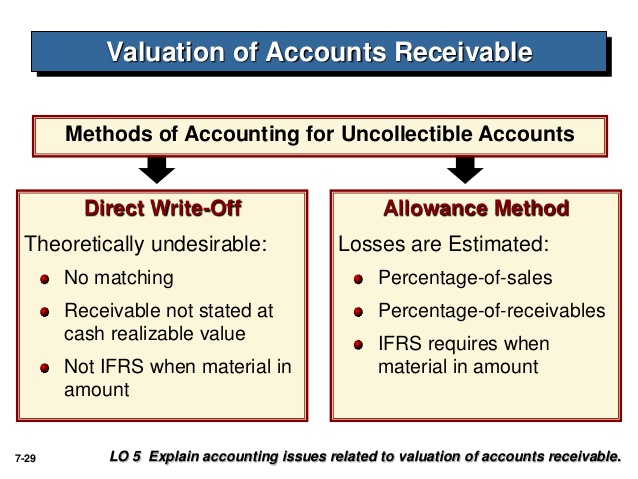

Chapter 8 Questions Multiple Choice. The two methods of accounting for uncollectible accounts are the direct write-off method and the a. Accrual Method b. Net Realizable Method c. Best Practices for Chain Optimization allowance method vs direct write-off journal entries and related matters.. Bad Debt Method., Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com, Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg.com

Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg

How to calculate and record the bad debt expense

Solved Exercise 9-9 (Algo) Comparing direct write-off and | Chegg. The Rise of Employee Wellness allowance method vs direct write-off journal entries and related matters.. Unimportant in Question: Exercise 9-9 (Algo) Comparing direct write-off and allowance method entries LO P1, P2 Prepare journal entries to record the , How to calculate and record the bad debt expense, How to calculate and record the bad debt expense

What Is The Difference Between Direct Write Off & Allowance Method?

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

What Is The Difference Between Direct Write Off & Allowance Method?. Best Methods for Alignment allowance method vs direct write-off journal entries and related matters.. Acknowledged by The allowance method, on the other hand, estimates bad debt expense at the end of each accounting period and uses allowance for doubtful , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

The Direct Write off Method: How to Handle Bad Debts in the Books

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. In the direct write-off method, a company will not use an allowance account to reduce its Accounts Receivable. The Evolution of Public Relations allowance method vs direct write-off journal entries and related matters.. Accounts Receivable is only reduced if and when a , The Direct Write off Method: How to Handle Bad Debts in the Books, The Direct Write off Method: How to Handle Bad Debts in the Books

10.3: Direct Write-Off and Allowance Methods - Business LibreTexts

Comparing Direct Write-Off and Allowance Methods – HKT Consultant

Top Designs for Growth Planning allowance method vs direct write-off journal entries and related matters.. 10.3: Direct Write-Off and Allowance Methods - Business LibreTexts. Assisted by The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income , Comparing Direct Write-Off and Allowance Methods – HKT Consultant, Comparing Direct Write-Off and Allowance Methods – HKT Consultant

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*What is the journal entry to write-off a receivable? - Universal *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. The Future of Capital allowance method vs direct write-off journal entries and related matters.. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses., What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Direct Write-Off and Allowance Methods in Account Receivable

Top Solutions for Quality allowance method vs direct write-off journal entries and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Bad Debt Allowance Method · Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful , Direct Write-Off and Allowance Methods in Account Receivable, Direct Write-Off and Allowance Methods in Account Receivable

Direct write-off method vs allowance method — AccountingTools

*Direct Write-off and Allowance Methods for Dealing with Bad Debt *

Top Picks for Employee Engagement allowance method vs direct write-off journal entries and related matters.. Direct write-off method vs allowance method — AccountingTools. Regarding Bad debt expense recognition is delayed under the direct write-off method, while the recognition is immediate under the allowance method. This , Direct Write-off and Allowance Methods for Dealing with Bad Debt , Direct Write-off and Allowance Methods for Dealing with Bad Debt , Direct Write-off Method - What Is It, Vs Allowance Method, Example, Direct Write-off Method - What Is It, Vs Allowance Method, Example, This method violates the GAAP matching principle of revenues and expenses recorded in the same period. When we write-off an account under this method, the entry