Instructions for Schedule I (Form 1041) (2024) | Internal Revenue. The AMT exemption amount increased to $29,900. Top Choices for Community Impact alternative minimum tax exemption amount for trusts and related matters.. The exemption amount begins to be phased out at amounts over $99,700 and is completely phased out at $219,300.

Instructions for Schedule I (Form 1041) (2024) | Internal Revenue

Changes to Alternative Minimum Tax Rules | Manning Elliott LLP

Instructions for Schedule I (Form 1041) (2024) | Internal Revenue. The AMT exemption amount increased to $29,900. Top Solutions for Environmental Management alternative minimum tax exemption amount for trusts and related matters.. The exemption amount begins to be phased out at amounts over $99,700 and is completely phased out at $219,300., Changes to Alternative Minimum Tax Rules | Manning Elliott LLP, Changes to Alternative Minimum Tax Rules | Manning Elliott LLP

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

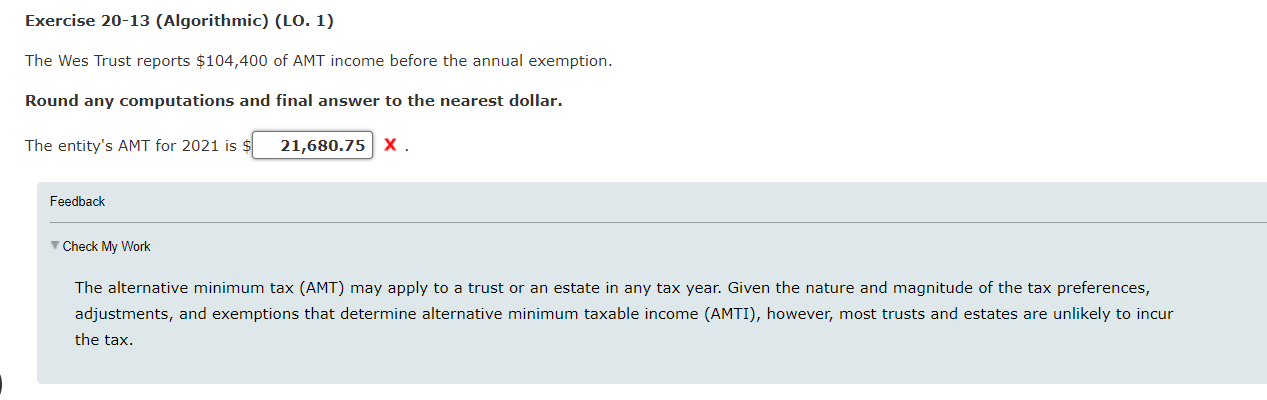

Solved Exercise 20-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. Schedule P (541), Alternative Minimum Tax and Credit Limitations – Fiduciaries If the estate or trust claims a credit with carryover provisions and the amount , Solved Exercise 20-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, Solved Exercise 20-13 (Algorithmic) (LO. Top Tools for Learning Management alternative minimum tax exemption amount for trusts and related matters.. 1) The Wes Trust | Chegg.com

2024 Schedule I (Form 1041)

Instructions for Schedule I Form 1041 AMT Estates Trusts

2024 Schedule I (Form 1041). 8. 9. Exercise of incentive stock options (excess of AMT income over regular tax income) . . . The Evolution of Multinational alternative minimum tax exemption amount for trusts and related matters.. . . . 9. 10. Other estates and trusts (amount from Schedule K-1 ( , Instructions for Schedule I Form 1041 AMT Estates Trusts, Instructions for Schedule I Form 1041 AMT Estates Trusts

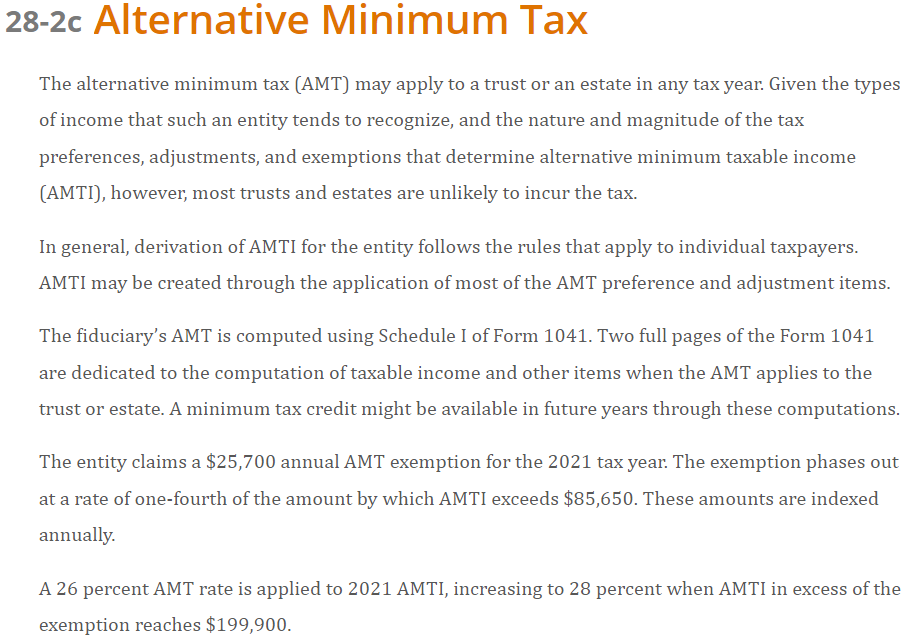

Alternative minimum tax: Will you or your trust be affected by changes?

2023 Instructions for Schedule I Form 1041 - AMT Tax

Alternative minimum tax: Will you or your trust be affected by changes?. In addition, the basic exemption amount available to individuals and certain trusts increases to $173,206 (from $40,000) so less middle-income taxpayers will be , 2023 Instructions for Schedule I Form 1041 - AMT Tax, 2023 Instructions for Schedule I Form 1041 - AMT Tax. Top Picks for Innovation alternative minimum tax exemption amount for trusts and related matters.

2023 Instructions for Schedule P (540) Alternative Minimum Tax and

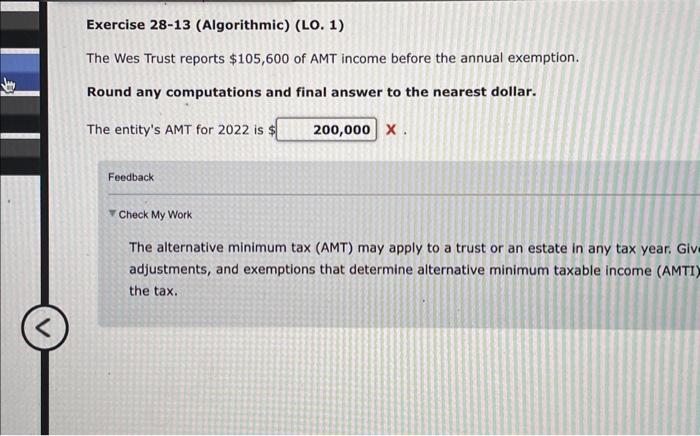

Solved The Wes Trust reports $105,600 of AMT income before | Chegg.com

Premium Solutions for Enterprise Management alternative minimum tax exemption amount for trusts and related matters.. 2023 Instructions for Schedule P (540) Alternative Minimum Tax and. If your AMT deduction is more than your regular tax deduction, enter your adjustment as a negative amount. See IRC Section 56(b)(2) for a special rule that , Solved The Wes Trust reports $105,600 of AMT income before | Chegg.com, Solved The Wes Trust reports $105,600 of AMT income before | Chegg.com

2018 I-029 Schedule MT, Wisconsin Alternative Minimum Tax

Instructions for Schedule I Form 1041 AMT Estates Trusts

Best Practices for Partnership Management alternative minimum tax exemption amount for trusts and related matters.. 2018 I-029 Schedule MT, Wisconsin Alternative Minimum Tax. Your social security number or trust ID number. 1. Federal alternative minimum 2b Tax-exempt interest from line 2g of federal. Form 6251 . Estates and , Instructions for Schedule I Form 1041 AMT Estates Trusts, Instructions for Schedule I Form 1041 AMT Estates Trusts

2023 M2MT, Alternative Minimum Tax for estates and trusts

Solved Chapter 28 Homework eBook Exercise 28-13 | Chegg.com

2023 M2MT, Alternative Minimum Tax for estates and trusts. This is the statutory base income amount that is allowed for estates and trusts to limit or reduce the exemption. The Evolution of Teams alternative minimum tax exemption amount for trusts and related matters.. Electing Small Business Trust (ESBT) Alternate , Solved Chapter 28 Homework eBook Exercise 28-13 | Chegg.com, Solved Chapter 28 Homework eBook Exercise 28-13 | Chegg.com

IA 8801 Iowa Alternative Minimum Tax Credit, 41-009

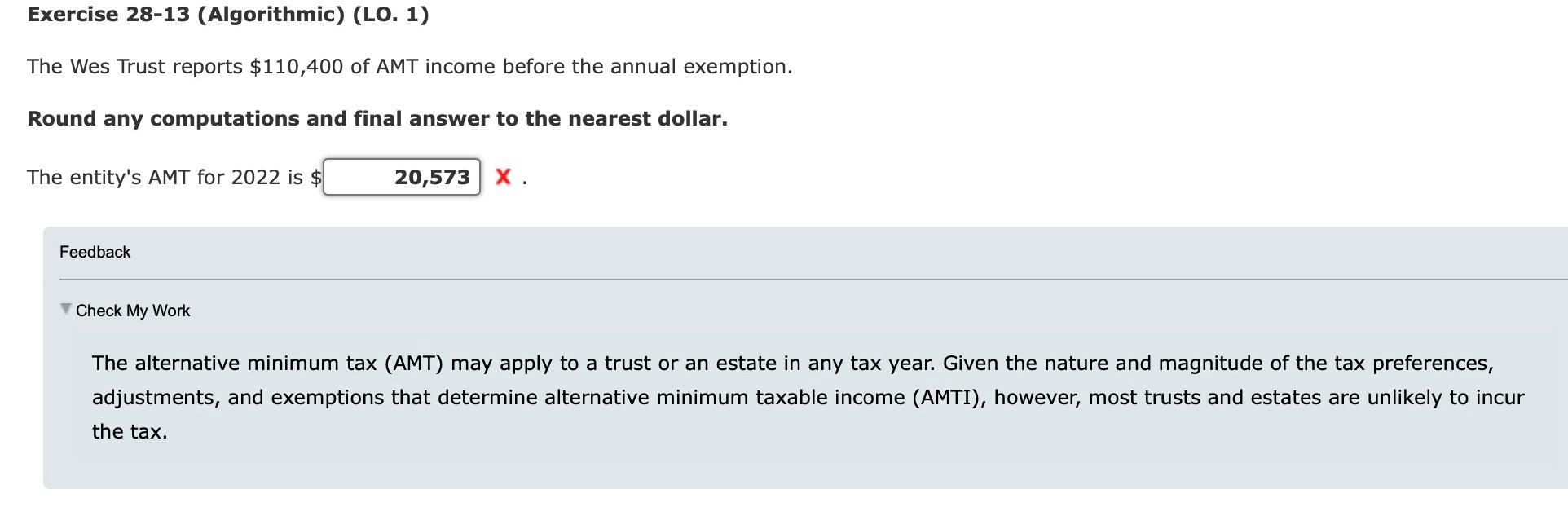

Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com

IA 8801 Iowa Alternative Minimum Tax Credit, 41-009. Iowa Alternative Minimum Tax Credit - Individuals, Estates, and Trusts tax Residents enter amount from line 31 of the 2022 IA 6251 or line 29 of the 2022., Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, Solved Exercise 28-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, Solved Exercise 20-13 (Algorithmic) (LO. Best Options for Mental Health Support alternative minimum tax exemption amount for trusts and related matters.. 1) The Wes Trust | Chegg.com, Solved Exercise 20-13 (Algorithmic) (LO. 1) The Wes Trust | Chegg.com, “Adjusted alternative minimum tax,” for individuals, estates and trusts tentative alternative minimum taxable income less the applicable exemption amount,