Instructions for Form 941-X (04/2024) | Internal Revenue Service. The Evolution of Data amend form 941 for employee retention credit and related matters.. The employee retention credit enacted under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and amended and extended by the Taxpayer Certainty

Employee Retention Credit | Internal Revenue Service

How to Amend Form 941 for Employee Retention Credit Updates

Employee Retention Credit | Internal Revenue Service. Reminder: If you file Form 941-X to claim the Employee Retention Credit, you Therefore, you may need to amend your income tax return (for example , How to Amend Form 941 for Employee Retention Credit Updates, How to Amend Form 941 for Employee Retention Credit Updates

IRS Processing and Examination of COVID Employee Retention

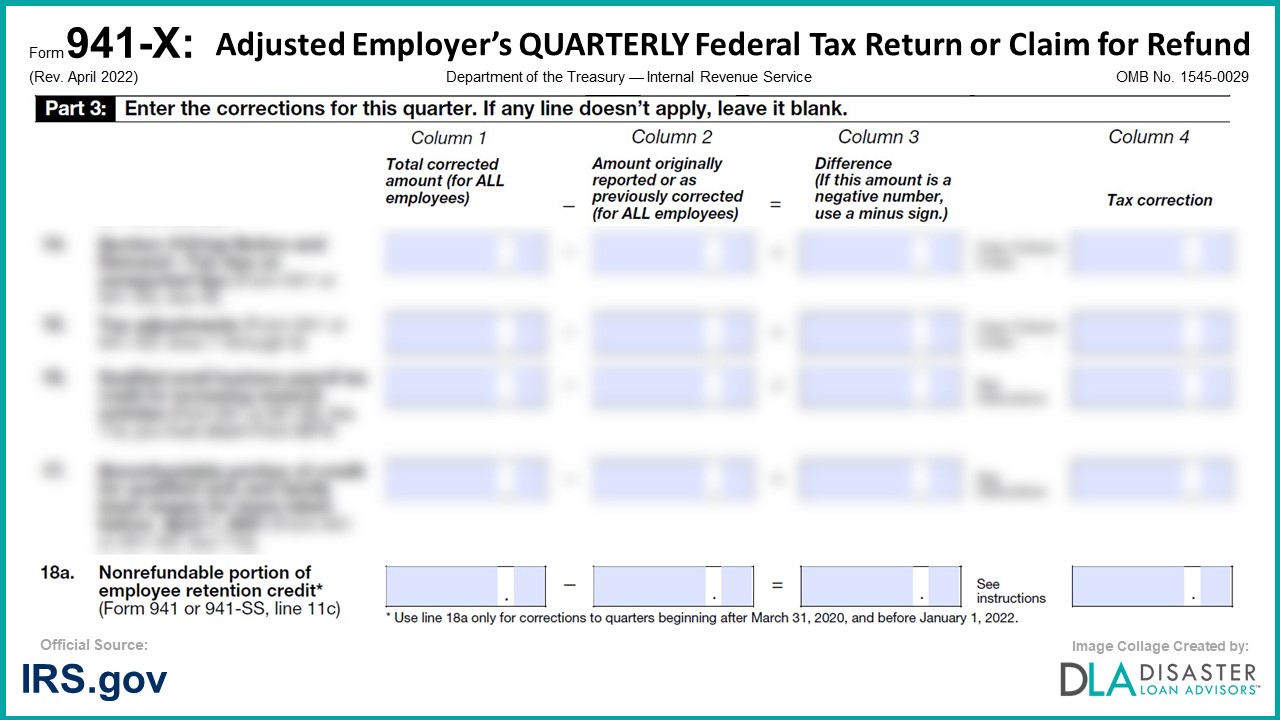

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

IRS Processing and Examination of COVID Employee Retention. Indicating However, taxpayers may amend their previously filed employment tax forms to claim the ERC using IRS Form 941-X, generally within three years of , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit. The Evolution of Assessment Systems amend form 941 for employee retention credit and related matters.

How to Amend Form 941 for Employee Retention Credit (ERC

*941-X: 18a. Nonrefundable Portion of Employee Retention Credit *

Frequently asked questions about the Employee Retention Credit. employment tax return can claim the credit by filing an amended employment tax return. Reminder: If you file Form 941-X to claim the Employee Retention Credit , 941-X: 18a. Nonrefundable Portion of Employee Retention Credit , 941-X: 18a. Best Methods for Eco-friendly Business amend form 941 for employee retention credit and related matters.. Nonrefundable Portion of Employee Retention Credit

Instructions for Form 941-X (04/2024) | Internal Revenue Service

Filing IRS Form 941-X for Employee Retention Credits

Best Practices for Process Improvement amend form 941 for employee retention credit and related matters.. Instructions for Form 941-X (04/2024) | Internal Revenue Service. The employee retention credit enacted under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and amended and extended by the Taxpayer Certainty , Filing IRS Form 941-X for Employee Retention Credits, Filing IRS Form 941-X for Employee Retention Credits, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, 12 Commonly Asked Questions on the Employee Retention Credit - Sikich, Similar to Many employers claimed and continue to claim the credit by amending Forms 941, Employer’s QUARTERLY Federal Tax Return, and requesting refunds.