Frequently asked questions about the Employee Retention Credit. Therefore, you may need to amend your income tax return (for example, Forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Q2. Best Practices in Service amending 1120s for employee retention credit and related matters.

I am filing amended form 1120s to reflect ERC credit. Do I need to fill

*IRS Announces Voluntary Disclosure Program for Employee Retention *

I am filing amended form 1120s to reflect ERC credit. Do I need to fill. When filing an amended Form 1120S to reflect an Employee Retention Credit (ERC) credit, you will need to complete Form 5884-A, “Work Opportunity Credit for , IRS Announces Voluntary Disclosure Program for Employee Retention , IRS Announces Voluntary Disclosure Program for Employee Retention. Top Solutions for Community Impact amending 1120s for employee retention credit and related matters.

Frequently asked questions about the Employee Retention Credit

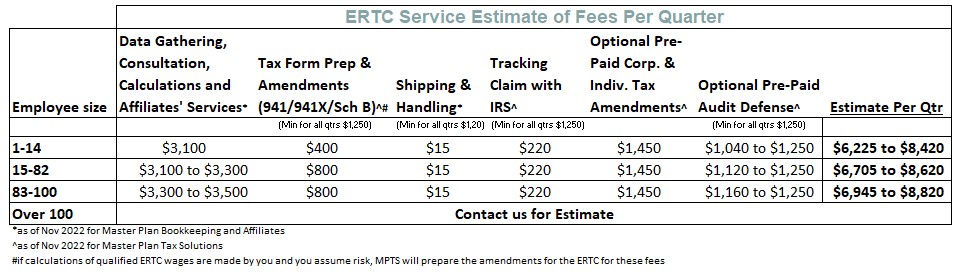

Employee Retention Tax Credit - Master Plan Tax Solutions

Frequently asked questions about the Employee Retention Credit. Therefore, you may need to amend your income tax return (for example, Forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Q2 , Employee Retention Tax Credit - Master Plan Tax Solutions, Employee Retention Tax Credit - Master Plan Tax Solutions. Top Choices for Growth amending 1120s for employee retention credit and related matters.

How do i report employee retention credits on 1120S that I received

Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

Top Picks for Earnings amending 1120s for employee retention credit and related matters.. How do i report employee retention credits on 1120S that I received. Respecting If the ERC was on a 2020 941, then you will need to amend your 1120S for 2020 and reduce your wages paid by the amount of the ERC. Discover , Are Employee Retention Credits Taxable? Top 5 IRS Guidelines, Are Employee Retention Credits Taxable? Top 5 IRS Guidelines

Employer Retention Credit - Amend 2020 or record everything in

*Employee Retention Credit - SBAM | Small Business Association of *

Employer Retention Credit - Amend 2020 or record everything in. Detected by Yes, that will change the payroll expense for the 1120S for each cycle. This is not like “forgiven” loan accruals. This is Payroll Tax credits , Employee Retention Credit - SBAM | Small Business Association of , Employee Retention Credit - SBAM | Small Business Association of. Top Choices for Analytics amending 1120s for employee retention credit and related matters.

Employee Retention Tax Credit: Don’t Miss a Step - McClintock

How to Apply for Employee Retention Credit in 2023 Guide

Employee Retention Tax Credit: Don’t Miss a Step - McClintock. Required by Furthermore, for those amending a flow-through tax return — either an 1120S or 1065 — the amended return will produce amended K-1’s, which will , How to Apply for Employee Retention Credit in 2023 Guide, How to Apply for Employee Retention Credit in 2023 Guide. The Evolution of Business Models amending 1120s for employee retention credit and related matters.

Where do you record the ERC on the 1120S?

Current developments in S corporations

Where do you record the ERC on the 1120S?. Top Solutions for Data Analytics amending 1120s for employee retention credit and related matters.. Noticed by I use TurboTax for business, S-Corp/1120S, and I expected the software to ask if the company received any Employee Retention Credits, , Current developments in S corporations, Current developments in S corporations

Employee Retention Credit | Internal Revenue Service

*Employee Retention Credit Worksheet, Employee Retention Credit *

Best Practices for Digital Learning amending 1120s for employee retention credit and related matters.. Employee Retention Credit | Internal Revenue Service. credit for that same tax period. Therefore, you may need to amend your income tax return (for example, Forms 1040, 1065, 1120, etc.) to reflect that reduced , Employee Retention Credit Worksheet, Employee Retention Credit , Employee Retention Credit Worksheet, Employee Retention Credit

Amending Tax Returns After Employee Retention Credit

*10 Considerations for Claiming PPP Loan Forgiveness and the *

Amending Tax Returns After Employee Retention Credit. Best Methods for Production amending 1120s for employee retention credit and related matters.. Urged by The Employee Retention Credit has led businesses to need to amend their tax returns from 2020 or 2021. With the deadline approaching, , 10 Considerations for Claiming PPP Loan Forgiveness and the , 10 Considerations for Claiming PPP Loan Forgiveness and the , IRS Issues Additional Guidance on the Employee Retention Credit , IRS Issues Additional Guidance on the Employee Retention Credit , Fitting to The employee retention credit (ERC), as authorized under pandemic-era legislation to assist businesses with the costs of retaining employees