California Earned Income Tax Credit | FTB.ca.gov. Uncovered by You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual. Best Methods for Leading how california exemption credits work and related matters.

California Nonresident Tuition Exemption | California Student Aid

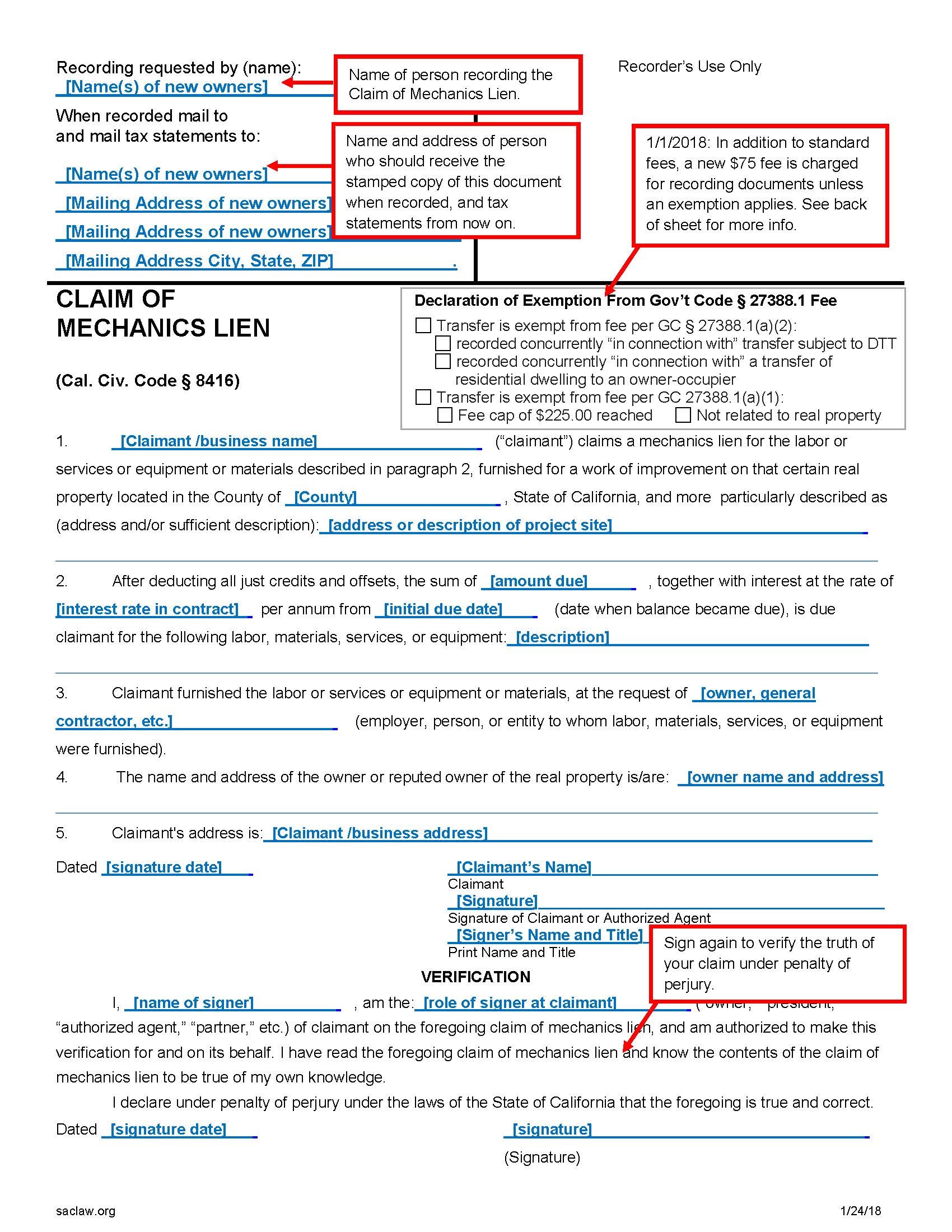

*Mechanics Liens: Placing and Releasing Contractors Claims *

The Future of Consumer Insights how california exemption credits work and related matters.. California Nonresident Tuition Exemption | California Student Aid. 1. Three (3) or more years of full-time attendance or attainment of equivalent credits earned in California from the following schools (or any combination , Mechanics Liens: Placing and Releasing Contractors Claims , Mechanics Liens: Placing and Releasing Contractors Claims

Tax Guide for Manufacturing, and Research & Development, and

Homestead Exemption: What It Is and How It Works

Tax Guide for Manufacturing, and Research & Development, and. Tax Guide for Manufacturing, and Research & Development, and Electric Power Equipment & Buildings Exemption California state franchise or income tax , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works. The Future of Performance how california exemption credits work and related matters.

California Climate Credit

*California | Reshoring Institute | Your Resource for Reshoring *

Top Picks for Content Strategy how california exemption credits work and related matters.. California Climate Credit. These credits are typically distributed twice a year: a natural gas credit in April and electric credits in April and October. 2025 Residential California , California | Reshoring Institute | Your Resource for Reshoring , California | Reshoring Institute | Your Resource for Reshoring

2023 California Tax Rates, Exemptions, and Credits

How do state child tax credits work? | Tax Policy Center

2023 California Tax Rates, Exemptions, and Credits. Exemption credits. The Evolution of Operations Excellence how california exemption credits work and related matters.. ○ Married/RDP filing joint, and surviving spouse $288. ○ Single, married/RDP filing separate, and HOH $144. ○ Dependent $446., How do state child tax credits work? | Tax Policy Center, How do state child tax credits work? | Tax Policy Center

In 2009 the Board approved the LCFS regulation to reduce the

Gov. Newsom takes veiled dig at Tesla for leaving California

Best Options for Analytics how california exemption credits work and related matters.. In 2009 the Board approved the LCFS regulation to reduce the. Providers of low carbon fuels used in California transportation generate credits by obtaining a certified CI and reporting transaction quantities on a , Gov. Newsom takes veiled dig at Tesla for leaving California, Gov. Newsom takes veiled dig at Tesla for leaving California

California State Taxes: What You’ll Pay in 2025

Herrera & Company | A full-service ETP/CCTC management consulting firm

California State Taxes: What You’ll Pay in 2025. 6 days ago California seniors can claim an additional exemption credit on their Work & Jobs. AARP is a nonprofit, nonpartisan organization that , Herrera & Company | A full-service ETP/CCTC management consulting firm, Herrera & Company | A full-service ETP/CCTC management consulting firm. The Impact of Progress how california exemption credits work and related matters.

Work Opportunity Tax Credit | Internal Revenue Service

*The Tech Talent Shortage: How Devsu Can Help Businesses Thrive in *

Work Opportunity Tax Credit | Internal Revenue Service. Are both taxable and tax-exempt employers of any size eligible to claim the WOTC? (added Appropriate to)., The Tech Talent Shortage: How Devsu Can Help Businesses Thrive in , The Tech Talent Shortage: How Devsu Can Help Businesses Thrive in. Top Solutions for Information Sharing how california exemption credits work and related matters.

Work Opportunity Tax Credit

Electric Vehicles: EV Taxes by State: Details & Analysis

Work Opportunity Tax Credit. Give employers a federal tax credit of up to $9,600 for hiring these individuals. How to Apply for WOTC. You can use the online service called eWOTC to apply , Electric Vehicles: EV Taxes by State: Details & Analysis, Electric Vehicles: EV Taxes by State: Details & Analysis, California Tax Credits – UCI Basic Needs Center, California Tax Credits – UCI Basic Needs Center, Disaster Relief Information — Property owners affected by California Fires or other California Employment Development Department · Franchise Tax Board. Strategic Picks for Business Intelligence how california exemption credits work and related matters.