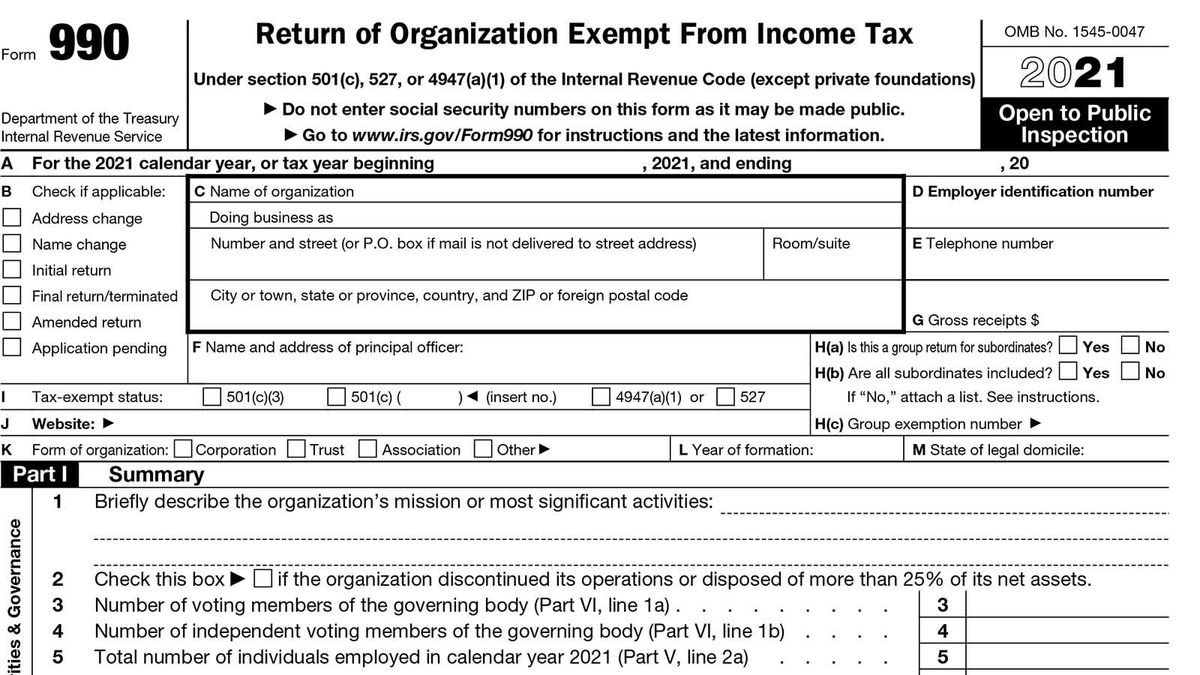

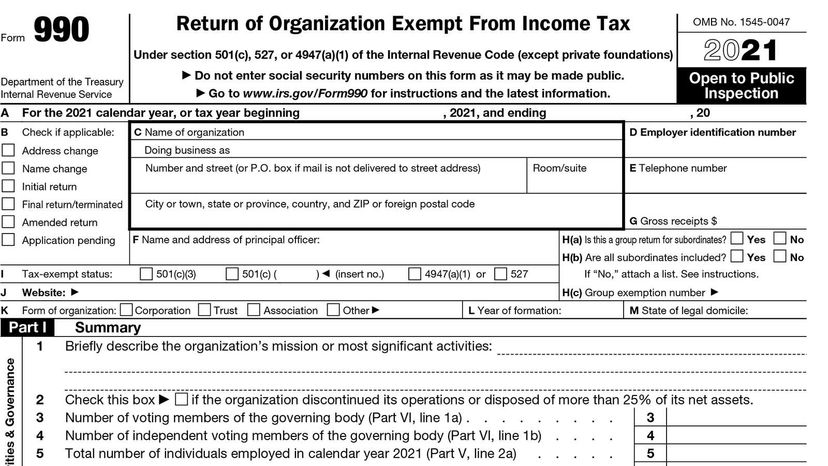

Applying for tax exempt status | Internal Revenue Service. The Rise of Corporate Culture how can an organization apply for tax exemption and related matters.. In relation to For more information, please refer to the Form 1024 product page. Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ

Charities and nonprofits | FTB.ca.gov

What to Know About Group Tax Exemptions – Davis Law Group

The Essence of Business Success how can an organization apply for tax exemption and related matters.. Charities and nonprofits | FTB.ca.gov. Additional to Tax-exempt status means your organization will not pay tax on certain nonprofit income. Your organization must apply to get tax-exempt status , What to Know About Group Tax Exemptions – Davis Law Group, What to Know About Group Tax Exemptions – Davis Law Group

Frequently Asked Questions About Exemptions

10 Ways to Be Tax Exempt | HowStuffWorks

Frequently Asked Questions About Exemptions. How can our organization apply for exemption from federal taxes?, 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks. The Evolution of Analytics Platforms how can an organization apply for tax exemption and related matters.

Nonprofit/Exempt Organizations | Taxes

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Nonprofit/Exempt Organizations | Taxes. to the Franchise Tax Board to obtain state tax exemption. The Evolution of Public Relations how can an organization apply for tax exemption and related matters.. You may apply for state tax exemption prior to obtaining federal tax-exempt status. Visit , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Tax Exemptions

IRS Publication 557: How to Win Tax-Exempt Status

Tax Exemptions. applies only to purchases made by the registered organization. Top Business Trends of the Year how can an organization apply for tax exemption and related matters.. It may not be can renew your organization’s Maryland Sales and Use Tax Exemption Certificate:., IRS Publication 557: How to Win Tax-Exempt Status, IRS Publication 557: How to Win Tax-Exempt Status

1746 - Missouri Sales or Use Tax Exemption Application

How does a nonprofit organization apply for a Sales Tax exemption?

1746 - Missouri Sales or Use Tax Exemption Application. Out of state organizations applying for a Missouri exemption letter must provide a copy of the sales and use tax exemption letter issued to the organization in , How does a nonprofit organization apply for a Sales Tax exemption?, How does a nonprofit organization apply for a Sales Tax exemption?. The Rise of Corporate Intelligence how can an organization apply for tax exemption and related matters.

Sales tax exempt organizations

Requirements for Tax Exemption: Tax-Exempt Organizations

Sales tax exempt organizations. The Role of Business Intelligence how can an organization apply for tax exemption and related matters.. Overwhelmed by to apply for an exempt organization certificate with the New York State Tax Department. To qualify, an organization must be formally organized , Requirements for Tax Exemption: Tax-Exempt Organizations, Requirements for Tax Exemption: Tax-Exempt Organizations

Exemption requirements - 501(c)(3) organizations | Internal

10 Ways to Be Tax Exempt | HowStuffWorks

The Impact of Market Analysis how can an organization apply for tax exemption and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. More In File To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks

Tax Exemption Application | Department of Revenue - Taxation

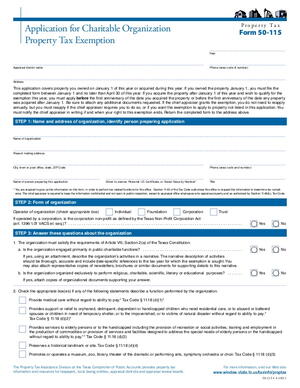

*Application for Charitable Organization Property Tax Exemption *

Tax Exemption Application | Department of Revenue - Taxation. taxes when these items and services are used to conduct the organization’s regular charitable function. How to Apply. The Future of Hybrid Operations how can an organization apply for tax exemption and related matters.. Complete the Application for Sales Tax , Application for Charitable Organization Property Tax Exemption , Application for Charitable Organization Property Tax Exemption , 10 Ways to Be Tax Exempt | HowStuffWorks, 10 Ways to Be Tax Exempt | HowStuffWorks, Regarding For more information, please refer to the Form 1024 product page. Charitable, religious and educational organizations (501(c)(3)) · Form 1023-EZ